While the overall market continues to chop in a sideway range, when looking underneath the hood at individual stocks within the US Stock market it gets me concerned. As I wrote in April here we continue to see fewer and fewer stocks making new highs and an increasing number of stocks making new lows. Unless this changes soon, we are headed for a correction (not a top or reversal) as the market is being held up by a minority of stocks (ie, Amazon, Netflix, Starbucks, etc). In my daily analysis I monitor hundreds of stock charts and continue to see a similar story and as time goes on, with greater frequency … topping patterns followed by breakdowns. Not every stock has topped or broken down but their numbers are dwindling. Two weeks ago I wrote about Green Mountain (GMCR) here that had already topped and had fallen more than 40%. This week I wanted to show you a couple more charts that are in the beginning stages of their declines. I have been watching both of these for months seeing the short opportunity develop in slow motion.

My first chart is that of Franklin Resources (BEN). Franklin is a well-run asset management holding company providing equity, fixed income, balanced, and multi-asset mutual funds through its subsidiaries. You can see the stock rose more than 110% from the bottom in 2011, topping in Jan 2014. Since then the stock has been bouncing between the top and bottom red horizontal lines ($49-$58) over the past 18 months creating a triple top with negative momentum divergence. This was a huge warning that a potential decline was in the cards. Friday it broke down below its bottom red support line and the bears pounced hard. If it does not reverse here soon, price will target T1 and, if weakness continues T2. For now, that is its targeted move. But, depending upon what happens forward, a much bigger bearish, head and shoulders topping pattern is developing with a more ominous target down to the lows of 2011.

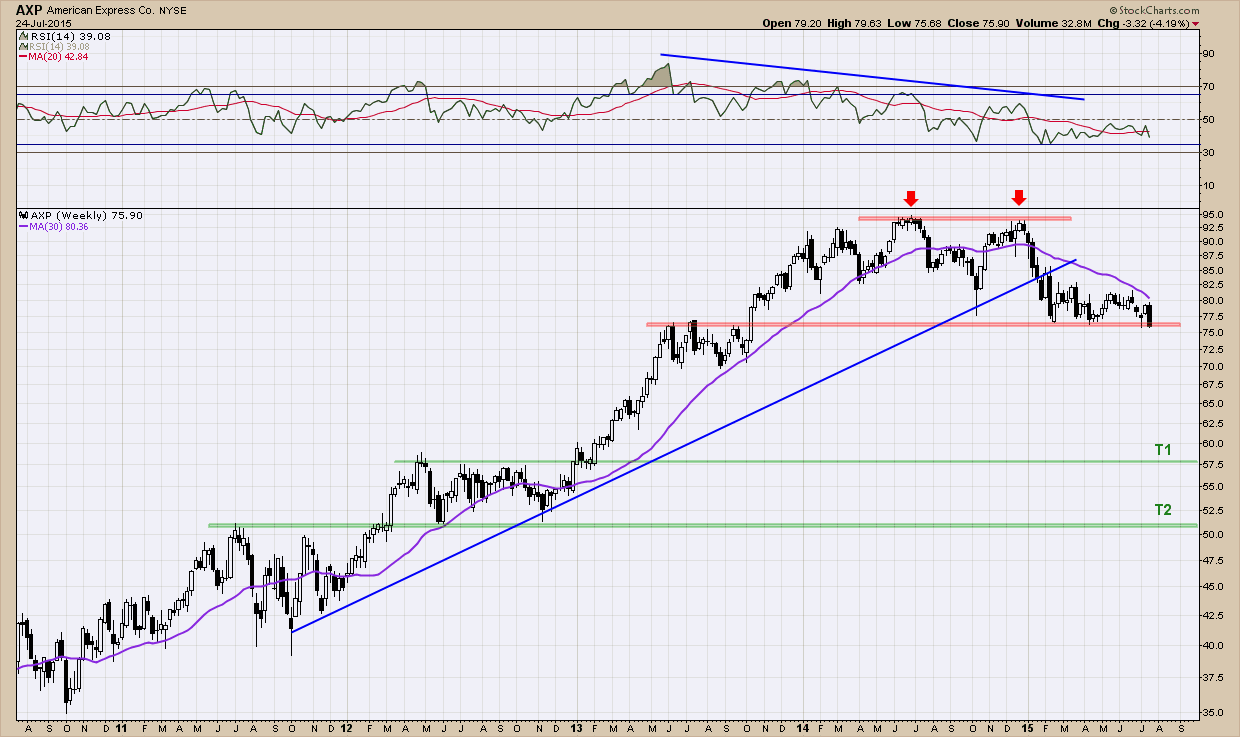

My second and last chart is that of American Express (AXP). As I am sure you all know American Express provides charge and credit payment card products and travel-related services. AXP rose 160% from its 2010 bottom topping in May of last year and like BEN above, has been bouncing between the red support and resistance lines and creating negative momentum divergence. Unlike BEN, it has formed only a double top and has yet to break down below its major support. If there is follow through to the downside from here, T1 is my first target with T2 providing a likely home if the correction were to gain steam.

Stocks topping are nothing new as it happens in bull markets and bear markets so there is no underlying message here other than we have more data points to keep us cautious. Reviewing what they look like and recognizing them as they develop is a powerful skill that aids in preserving capital. Right now there is much to be bearish about but with every bull market there is always a wall of worry to climb. And this bull is no different. I continue to say, you need to give the benefit of the doubt to the current trend (which is up) and let your investment process, not a WAG, determine your market exposure. Keep in mind you top-picking, semi-hibernating bears --- the S&P 500 did something in the first half of 2015 that it has not done since 1904 —it posted two consecutive (back to back) quarters of 0% gains. This has happened only one other time in the past 125 years, for either the Dow or the S&P 500 and the last time it did stocks surged 43% over the next two quarters.