My latest video post can be accessed at the youtube link below

https://youtu.be/tun1K1Ioykg

INVESTMENT EDGE

My latest video post can be accessed at the youtube link below

https://youtu.be/tun1K1Ioykg

The US stock market just can’t seem to catch any love. Fear indexes are ramping higher and investors are looking for excuses to exit the market. Greece, rising interest rates, valuations, the FED, China stock market crash, oil prices falling off a cliff, the wall of worry is getting higher each day. How is it with all of this as a negative market backdrop stocks can be within 2% of all-time highs? All you have to do is look under the hood and while the indexes are still holding up, the average stock is struggling.

Some stats may help explain (data provided by Ryan Detrick, CMT) -

· More than 120 of the 500 SP500 stocks are down more than 20% from 52 week high

· The average SP500 stock is down more than 14.5% from 52 week high

· Just slightly less than ½ of the SP500 stocks have prices below their important long term 200 day moving average

· Just under ½ of the SP500, 232 stocks, are in a death cross (50dma has crossed under 200dma)

o The best sector is health care where less than 13% fit

o At 80%+, energy and utilities are bringing up the rear.

· The Dow has been in a 6.4% trading range (from high to low) since the beginning of the year. This is the lowest year on record.

· The Dow was down the first seven of eight days in August, worst start to a month since down seven of eight in July ‘12.

As you can see while the overall index is doing ok, about half the stocks are either struggling or hurting. Maybe this is why it feels so bad. As Yoda would say “A precarious time in the markets, we have”. Until this gets resolved, sitting on your hands and doing nothing will likely be the most profitable strategy.

Below is a 5 year weekly chart of Coffee. After peaking in October last year the negative momentum divergence raised a warning flag a correction was likely. From that point coffee fell almost 45% over the next 10 months. During the last 6 months you can see it formed a bullish falling wedge pattern while creating positive momentum divergence. Last week coffee broke strongly out of the wedge higher confirming the move with very large volume (in bottom pane). While the last bottom in November of 2013 was V-shaped, I would not chase this here as I do not expect that to happen again. I would instead look for a higher low to be formed or a retest of that wedge breakout level. If investing in coffee beans is not for you, you had better go get your coffee "jones" filled at your local Starbucks before they raise prices again as the projected target for this breakout is 30%.

There is no one company that is covered by the media more than Apple. Anything you want to know about them you can find on the internet. As such, I tend to shy away from talking about them as it has likely been covered by someone somewhere at some time before. I do make exceptions when something of technical significance occurs which brings me to today's post.

Apple has grown to be such a large part of the US stock market as they constitute almost 15% of the Nasdaq 100 index and almost 4% of the SP500 index despite being only 1% and .2% of the number of companies within the index respectively. So it’s easy to understand, how Apple goes, so goes the markets and why it is covered in such depth.

As I was scanning my charts yesterday I noticed AAPL printed a very ugly, big red down candle on big volume. It also closed right on a very important support/resistance line making today’s action very important. It would either need to bounce higher and get the bulls back in control or breakdown setting up for a bigger fall. In the daily chart of AAPL below, you can see it gapped lower (which typically occurs when there is a breach of a major support line) today and sold off hard on even larger volume than yesterday’s. You can also see this move should not have been too much of a surprise as both momentum indicators, RSI and MACD, have been trending lower, since February even reaching bearish levels. If we get follow through in the coming days, the breakdown target is slightly above $104, about a 10% loss from its high. As you would expect and because of AAPL’s significance to the indexes, they too, closed lower today mostly due to AAPL's demise.

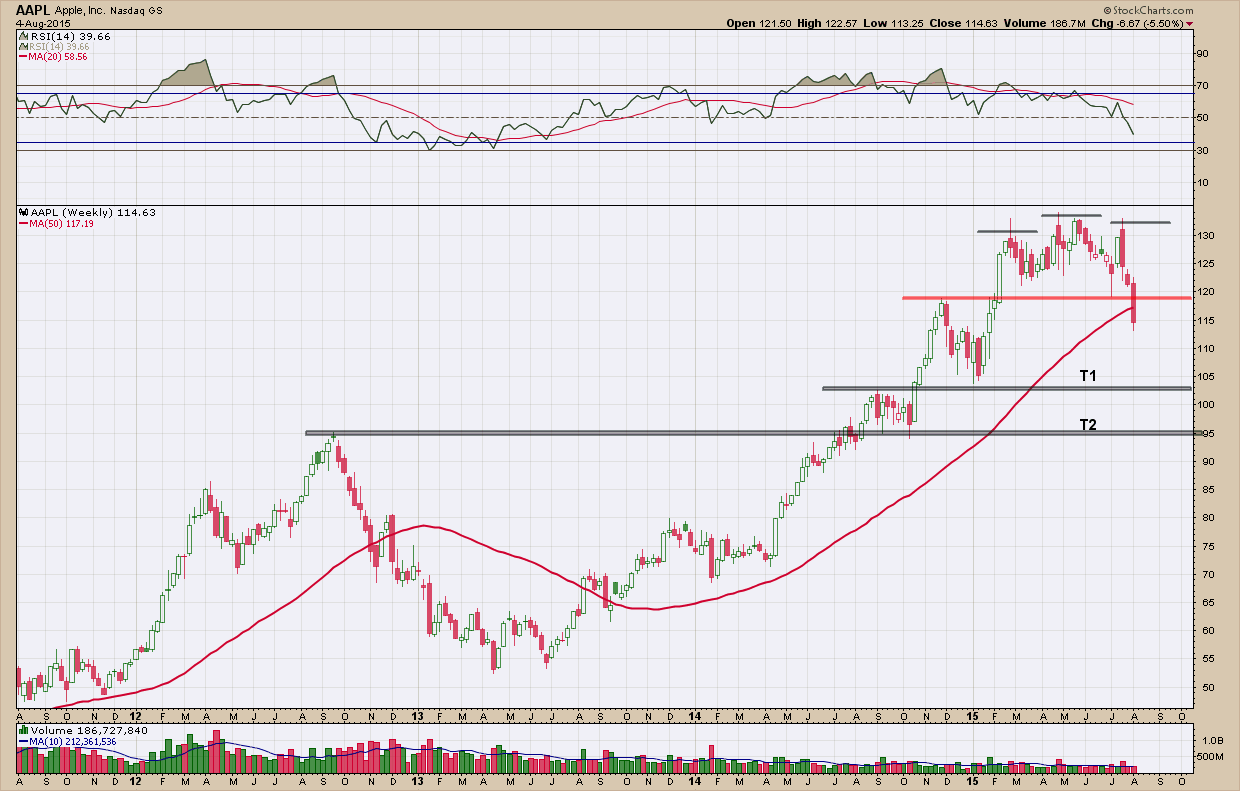

Taking a look at the a longer term, weekly look at the chart of AAPL below you can see the head and shoulders pattern which pierced through its neckline this week giving us downside target and matching up with the daily at around $104. If it were to overshoot and extend lower, there is a lot of support at the $100 level where it would likely bounce and find a swarm of buyers.

It will be interesting over the next few weeks to see this unfold right in front of our eyes with a stock that has almost a cult following and many worshipers. If I were a betting man and because of this, I would expect the stock would likely fall short of its downside targets as I expect the BTFD (buy the dip) crowd to be out in full force. That combined with the fact the 4th has historically been the worst day for a normally very boring stock market in August going back to 1950 has me leaning wherever this “retracement” ends will likely be a good buying opportunity. Either way this 10 round fight between the AAPL bears and fanboi’s is an interesting distraction that doesn’t require pay-per-view to watch. Grab some popcorn and get comfy.

Firmly imbedded in the Dog Days of summer, the markets are as fun to watch as Rosanne singing the national anthem. Maybe this will help .. a link to my July Market Recap Video