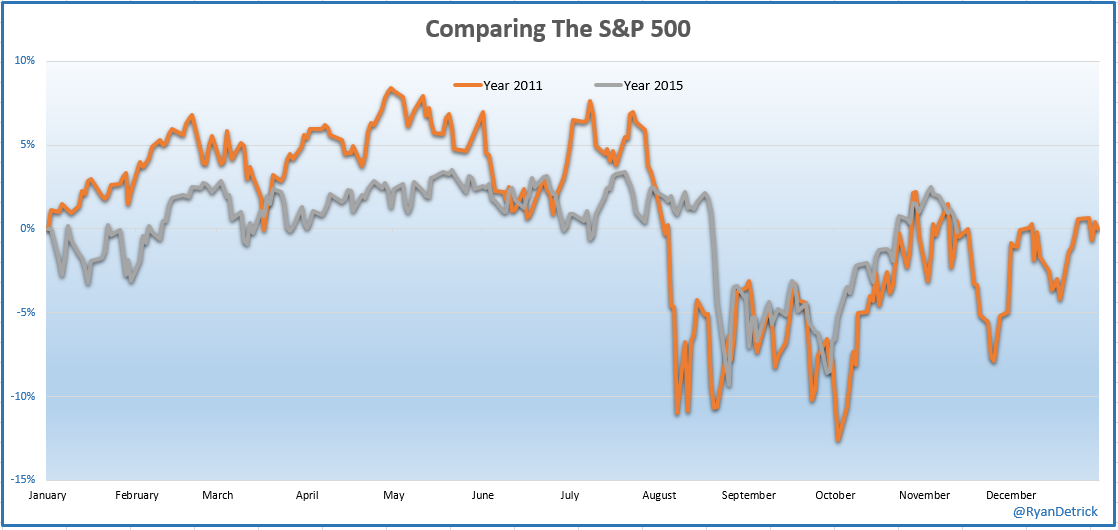

Mark Twain said “History does not repeat but it does rhyme”. You can take this truism about history and extend it to the investment markets. In fact, part of the basis for Technical Analysis is that the markets, which reflect the actions of all its participants, tend to repeat. Recognizing this and understanding how to use it can provide a significant advantage to its users. I must admit I have never found that analogs provide me any significant investment advantage but I do find them fun and entertaining (kind of like CNBC). Ryan Detrick, who I find to be one of the best market data analyst alive, posted this analog of 2015 stock market action against that from 2011. Maybe it’s my brain that makes me want to see patterns that may not really be there, but I find the similarity pretty uncanny.

For those who may not remember, 2011 was the first (and last) bear market (more than 20% decline) since the end of the 2008-09 financial crisis. After bottoming in 2011, prices chopped around for more than 6 months before we blasted off to new highs. I remember thinking at the time the 2-year rise from the ’09 bottom was nothing more than a bear market rally. I couldn’t have been more wrong and later learned valuable investment lessons regarding 1) not predicting the future and 2) only pay attention to price!

Like 2011, we are stuck in the middle of a trading range. Breaking above the May high means we are once again back in a bull market and it’s time to expand our equity exposure. A piercing and close below last month’s low means it’s time to hunker down and get defensive. Until one of those two happens, I am going to grab some popcorn, find a soft, comfy chair and enjoy the analog channel.