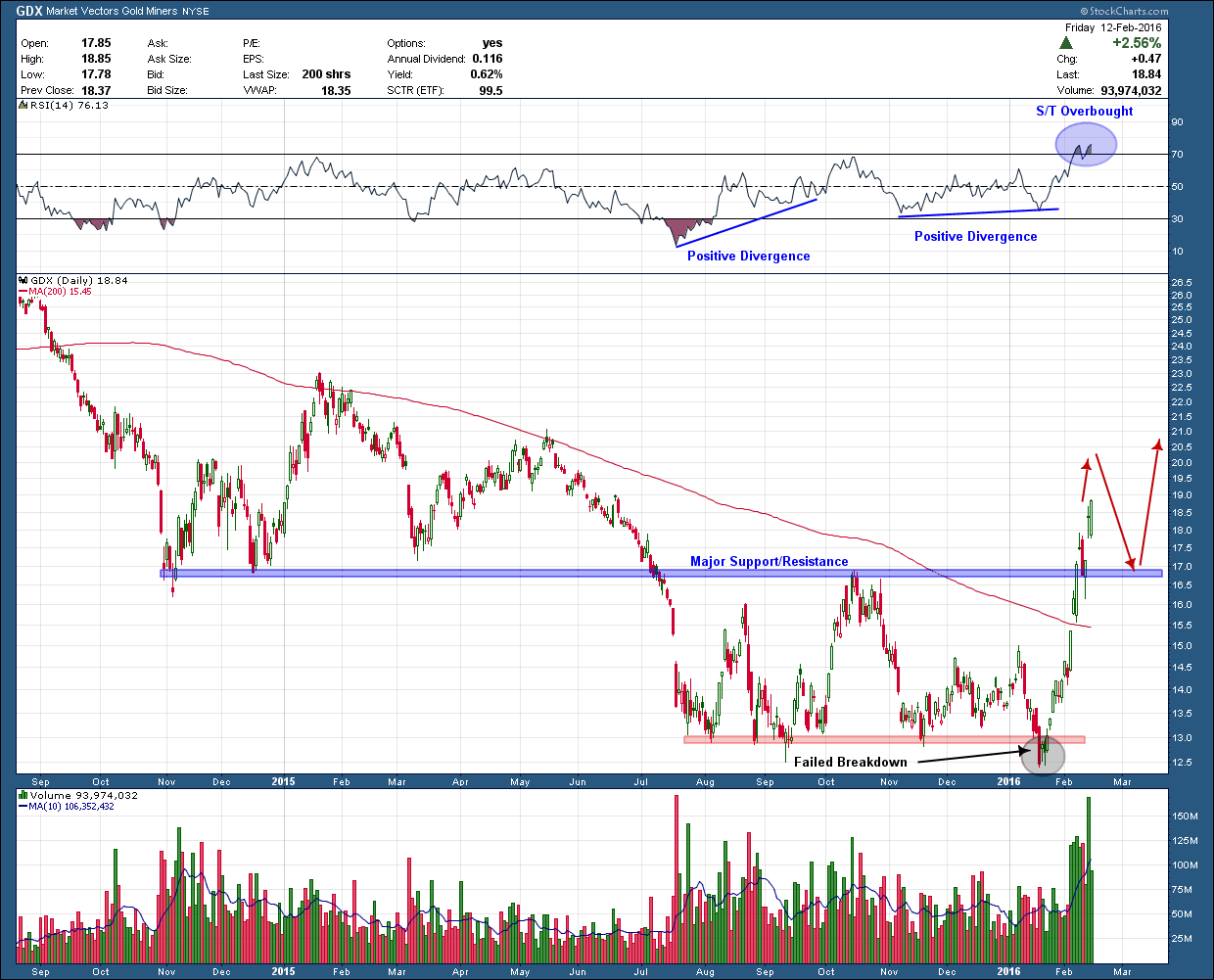

I wanted to take another look at mining stocks as something very interesting happened last week that has me potentially very intrigued. The chart below shows a long term chart of GDX, the larger mining stocks from its 2011 top. You should notice as it began its decent from its 1-year consolidation, the red 200 day moving average flattened and eventually curled down. Over the entire 5 year decline GDX has stayed below its blue dashed downtrend line and formed 4 separate attempts to bottom. The 4th and (so far) final began mid last year.

In strong downtrends violent, counter trend bounces happen drawing in bullish investors hoping they have found “the” bottom and a path to riches. Unfortunately, the bears have never relinquished control and each time the bulls have been sent packing, their tails between their legs and their accounts smaller than when they started. But we know eventually one of these bounces will find “the” bottom, a trend reversal will occur and a new bull market will begin. But when and how will you know? The simple answer is there is nothing that guarantees a bottom is in but there are some things I would need to see, the more that occur at the same time to feel confident putting client’s investment capital to work.

1. Weekly positive divergence – momentum (either RSI or MACD, or both) is moving higher while price continues to fall

2. Has been recently oversold (RSI < 30)

3. A bottoming pattern is in its late stages or has completed.

4. Price breaks a long term downtrend line to the upside

5. Volume is confirming (rising) the final stages of the pattern

6. The 200 day moving average has flattened and begun to point north.

7. At least one higher high and one higher low has been made.