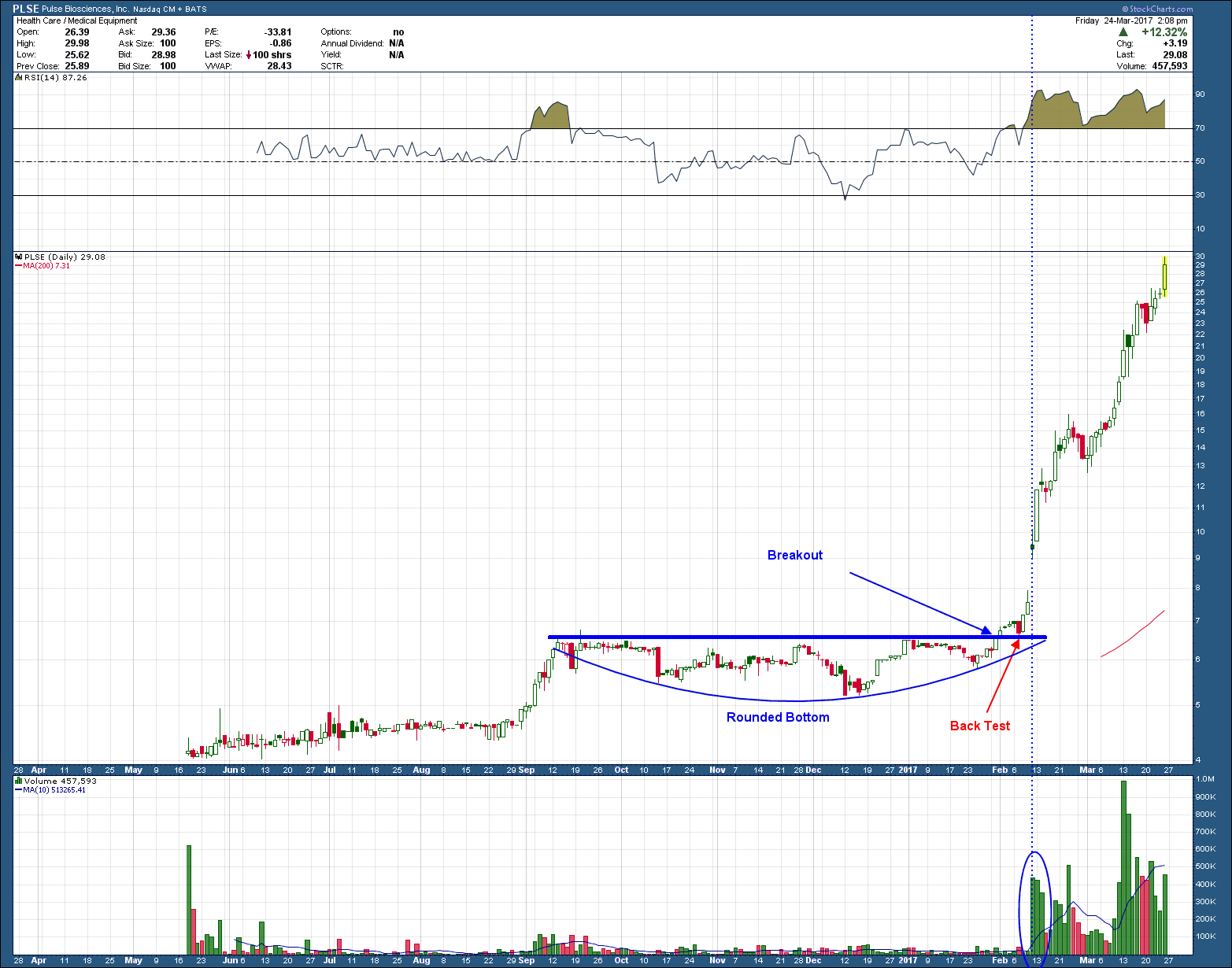

This article title appeared in Motley Fool in April of 2015. Apparently, coal stocks were given some get well medicine because they bottomed early last year and have been one of the best performing sectors since. As you can see in the coal sector ETF chart, KOL, below, it has risen more than 180% since that January 2016 low. In case you are wondering, yes, this is quite typical and more often than not, what happens. By the time “the story” makes it to mainstream media (this was also covered in WSJ, and other more well-known media publications after April, 2015), savvy investors know it’s time to load up … on the other side of the media story boat. And in the case of coal, fading the news outlets was again, a profitable outcome.

The interesting thing is, there is a lot more room to the upside if coal finds a cure. You can see in the above chart, the red smaller inverse head and shoulders pattern played out exactly as expected and hit its upside target, T1. But as can happen when an investment goes through a substantial decline and begins to recover, it creates (smaller) patterns within (bigger) patterns. This time is no different as the completion of the smaller red inverse head and shoulders created a larger, purple, inverse head and shoulders which, if played out. has an upside target some 60% higher. What makes this compelling besides the upside potential, is last week’s confirming breakout from the pattern as it gapped on the open on more than average volume.