Click here to read an interview with me, featured in the March 2015 issue of The Suit Magazine

Beaming with Pride

After almost 3 years of intense study and enormous commitment of time I am incredibly thrilled to let you know I have just received acceptance by the MTA Board of Directors as a Member of the Market Technicians Association (MTA). Along with this acceptance came the award of the prestigious CMT (Chartered Market Technician) designation which is considered the gold standard for technical analysis. To put this in perspective I am one of less than 1900 people worldwide to have been issued this since its founding in 1989.

I do have to admit that without question that this was the most challenging, demanding and humbling educational/learning experiences I have been involved in. If you look at the list of my credentials this is saying a lot. As such, it is the one I am most proud of.

The CMT is the only technical analysis training designed by professionals, for professionals. While there are countless technical analysis training programs available, only the CMT is designed to provide broad exposure to the classic literature in the field while emphasizing state-of-the-art analytical techniques. Over the past year while preparing for the final, level 3 exam, we have been working hard behind the scenes revamping both our investment methodology and process to incorporate the new found knowledge and expertise. In my opinion it could not come at a better time as the investment world is rapidly changing and advisers who don’t recognize it and adapt will likely be woefully unprepared for what I believe is likely ahead.

Royal Dutch Shell

I had an annual review meeting with a client a few weeks back and as we were wrapping it up he asked me what I thought of Royal Dutch Shell as an investment. I commented I didn’t have an opinion but would provide one once I looked at the chart. He went on to say he was watching CNBC and (Jim) Cramer was promoting the stock. I went on to tell him that the evidence supports that you would have had a better chance of making money by flipping a coin than following in his calls. In fact, you would have made more money if you had done just the opposite of what he said. Without skipping a beat my client said “he can’t be wrong all the time can he?”

There have been many studies done that show that “experts” (I prefer not to get into a debate on whether Mr. Cramer is an “expert”) as a whole don’t provide better recommendations than flipping a coin. An example of such a study is where they initially asked 3 groups to predict the future price of a security initially given 6 pieces of relevant information. What they found was all three groups (experts, a computer and those deemed “financially unsavvy”) all performed equally, none better than a coin flip. The second part of the study continued to progressively deliver more and more relevant information about the security until they were given 20 pieces in total. What they found was quite interesting. The computer improved its ability to forecast (increased to more than 60%), the financially unsavvy had no change (stayed at 50-50) but the “experts” ability fell from 50% to near 20%. There are reasons why this happen and for the sake of brevity it’s not relevant to this post. What is relevant is anyone listening and then acting on forecasts or predictions of the financial future will likely be disappointed.

The CXO Advisory Group (you can find more information here) provides a great service (some free some is subscription) where they deliver objective research and reviews to aid investing decisions. The thing I found most interesting is their “guru grades” (this section is free) where they assess the forecasting acumen of stock market “gurus” as a group and rank them as individuals according to their accuracy. In the paragraphs following this one, I have cut and pasted the results from their webpage. I am sure you have heard of some of the names covered but most will likely be recognizable only to industry insiders. Please keep in mind, there are always risks in drawing conclusions about individual results, especially those with small sample sizes. What their results do illustrate (and reinforce from numerous studies) is there are a few that get it right more often than not but on the whole, you would be no better off than if you flipped a coin. Forewarned is forearmed when it comes to listening to the noise on the financial networks and those who consistently attempt to forecast the future.

================================

Individual Grading Results

The following table lists the gurus graded, along with associated number of forecasts graded and accuracy. Names link to individual guru descriptions and forecast records. Further links to the source forecast archives embedded in these records are in some cases defunct. It appears that a forecasting accuracy as high as 70% is quite rare.

Cautions regarding interpretation of accuracies include:

Forecast samples for some gurus are small (especially in terms of forecasts formed on completely new information), limiting confidence in their estimated accuracies.Differences in forecast horizon may affect grades, with a long-range forecaster naturally tending to beat a short-range forecaster (see “Notes on Variability of Stock Market Returns”).Accuracies of different experts often cover different time frames according to the data available. An expert who is stuck on bullish (bearish) would tend to outperform in a rising (declining) stock market. This effect tends to cancel in aggregate.The private (for example, paid subscription) forecasts of gurus may be timelier and more accurate than the forecasts they are willing to offer publicly.

And in case you are interested … Royal Dutch Shell is down more than 10% from the day I had my client meeting.

Investment truths

Some number of month’s back I decided to change the focus of my posts to technical analysis (TA) based ideas. Because I am not really very good at writing and technical analysis provides a more visual medium it allows me to communicate ideas in charts rather than struggle verbally. While a picture can be worth a 1000 words, I do realize that the written word can be so powerful and prophetic. This week I read an article by Josh Brown (http://www.thereformedbroker.com) that I thought could be so very beneficial to every investor (including professionals) that I felt compelled to deviate from my charts. For the sake of brevity I am not including the entire article but rather just what I consider to be the most important parts. If you would like to read the article in its entirety, it is titled 7 Truths Investors Simply Cannot Accept. Hopefully you will find these investing nuggets as important as I did.

=============================================

Below are essential truths of investing that we are all aware of, but cannot accept at all times, no matter how much evidence we’ve seen.

Anyone can outperform at any time, no one can outperform all the time.

There is no manager, strategy, hedge fund or mutual fund or method that always works. If there were, everyone would immediately adopt it and its benefits would be quickly arbitraged away. No one and nothing stays on top forever; the more time that passes, the more likely you are to see excess returns from a given style of investing dwindle. Until it becomes so out of favor that no one’s doing it anymore. That’s when you should get interested.

Persistence of performance is nearly non-existent.

In business, we like to bet on winners and go with what’s working now. On the field of play, we like to get the ball to whichever of our teammates seems to have “the hot hand.” While we are usually rewarded for this behavior in real life, we are penalized for it in the stock market. Because there is absolutely zero correlation between a managers past or recent performance and what may happen in the future. The out-performers of last year are equally like to outperform next year as they are to under-perform, statistically speaking. There’s literally zero rhyme or reason, even though emotionally we always want to bet with and be aligned with today’s champion. Are there exceptions? Sure, there are - but not many. You constantly hear about the few dozen managers who’ve beaten the odds and consistently outperformed, you hear almost nothing about the millions who’ve tried and failed.

The crowd is always at its most wrong at the worst possible time. Over the long haul, only one thing is certain - there is no worse performing “asset class” than the average investor. In the aggregate, investors under-perform value stocks, growth stocks, foreign stocks, bonds, real estate, the price of oil, the price of gold, and even the inflation rate itself. Nothing under-performs the investor class. We know this from studying dollar-weighted returns, a glimpse into not just how an investment performs but in how much actual money had been gained or lost by the people who invested in it. On the whole, we bet big on assets that have already gone up a lot and sell out after they’ve gone down. We allocate heavily toward star managers just as their performance is about to revert to the mean - and we even pay up for the privilege. This is the eternal chase and it is as old as the hills.

Fear is significantly more powerful than greed. Behavioral science has proven that we feel anguish over losses much more acutely than we feel joy over gains. As the surviving scions of a hundred thousand years of human evolution, we can literally point to this risk aversion as the primary reason our ancestors managed to pass on their DNA while so many others did not. As the descendants of the more cautious members of the species, therefore, we are genetically hardwired to act quickly when we feel threatened - and this extends itself to our most precious modern resource, our money. That’s why markets drop much more quickly than they rise.

There is no pleasure without the potential for pain. Adjusted for inflation and taxes, the average annual return for stocks going back to 1926 is approximately four times greater than the return for ultra-safe bonds. Why? Because by investing in stocks, you are assuming more short-term risk and accepting greater volatility today. As a result, you are being rewarded in the future. It cannot ever be otherwise, this relationship between short-term risk and long-term gain is both elemental and incontrovertible. Wall Street makes the majority of its money by convincing its customers that this rule can be skirted, manipulated or defeated. People will pay anyone nearly any amount of money who promises them all of the ups with none of the downs. Despite the fact that, in the fullness of time, this cannot possibly be achieved.

Mar 17, 2014 - The ever shrinking investor time horizon

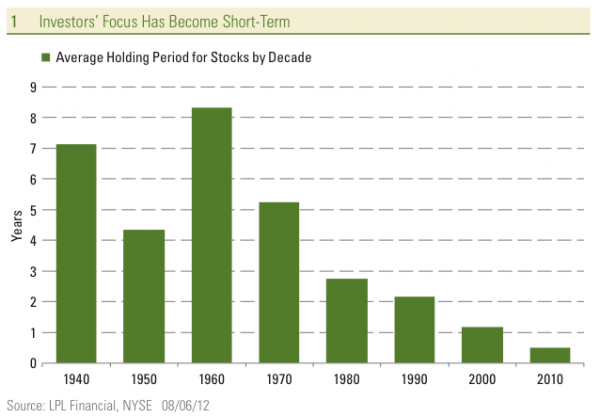

The attention span of today’s investors give ADHD a bad name and has driven an obsession with the short term. The average mutual fund holding period has fallen by 75% over the past 16 years. For stocks the data is even more bizarre as the average holding period has fallen from 8 years in the 1960’s to 5 days today. One of the consequences of such a short investment time horizon is that investors have begun to fear short-term market events and volatility as much or more than the factors that shape prospects for long-term economic and profit growth that drive stocks over the longer term.

As such, investor’s patience with performance has followed the same declining trend. While this may seem like the right thing to do, a study by the Brandes Institute showed this obsession with the short term a bad idea. Some interesting data from their study shows

Every best performing (10 year out-performance of SP>3% annually), long-run fund have had periods of major under-performance.

o The average worst 1 year period was ~20% under-performance (6-38% range)

o The average worst 3 year period was ~10% under-performance/year (1-20% range)

o 73% of these top performers found themselves in the lowest decile at least once

These types of results are not just unique to individuals who buy and sell mutual funds. Boyal and Wahal did a study on 4000+ decisions regarding hiring and firing of investment managers by pension plan sponsors. The results uncovered the classic hallmarks of returns-chasing behavior. The managers the sponsors tended to hire had an average out-performance of nearly 14% in the 3 years prior to hiring. After hiring those same manager’s performance was statistically insignificant … meaning their performance matched the benchmark. No out-performance. In contrast, those fired for performance reasons had underperformed by ~6% in the 3 years leading up to dismissal. However, in the 3 years after the firing, they outperformed by 5%.

This helps illustrate that 1) even the best long term performing money managers run into short term difficulties 2) Investors need to insure they keep their focus on the long term as short term reactions can have long term negative effects on their portfolios.