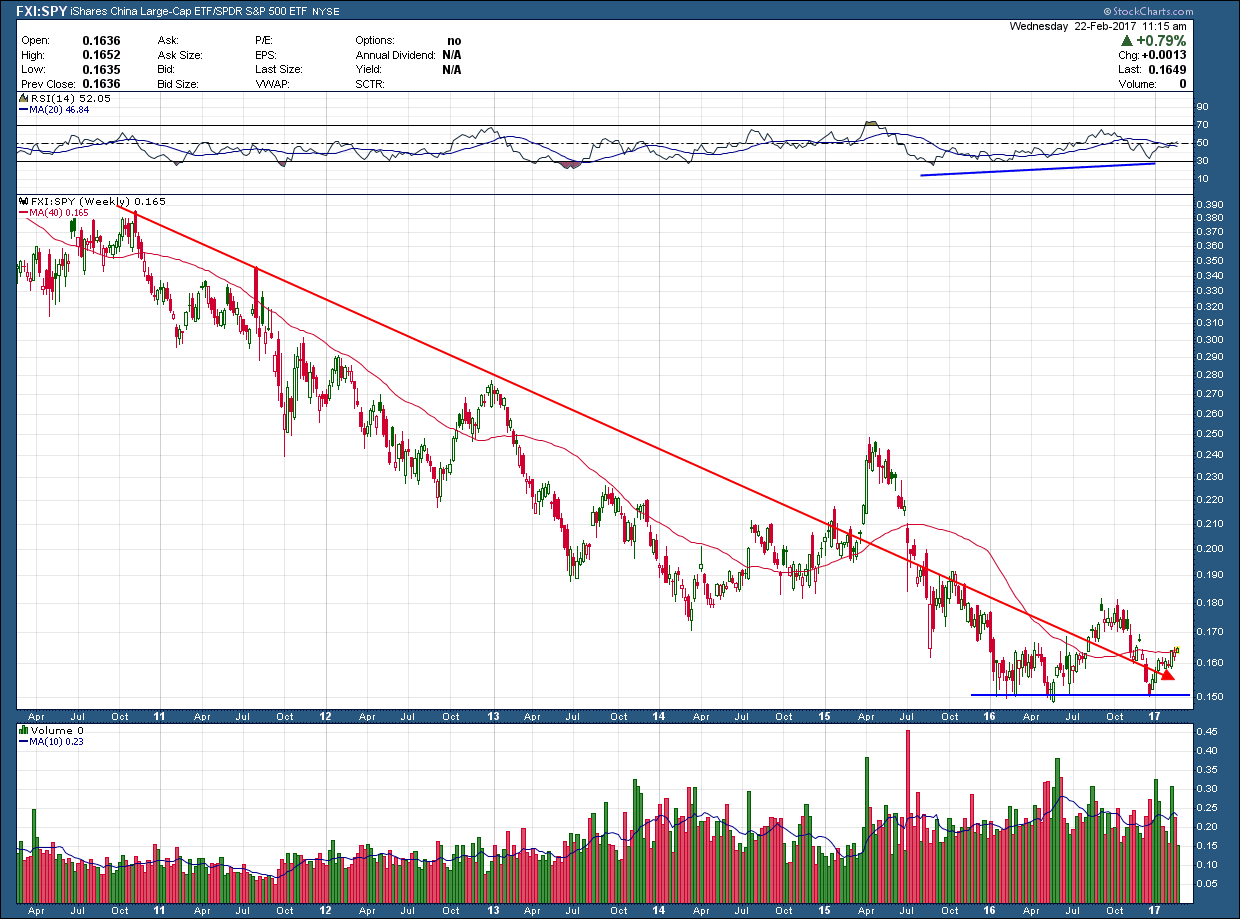

As a part of our process and before we put client money to work, we check to see if the investment in question is rising against both its benchmark and its US counterpart. Chinese stocks have massively underperformed their US counterparts over the past 5 years as you can see in the chart of the ratio of FXI (China ETF) to SPY (SP500) below. In fact, having money in China over the past 5 years has seen that investment lag the US benchmark by nearly 25%.

Fundamentally, Chinese stocks are more attractively priced, present a better value and potentially much greater upside. Because fundamentals don’t matter (until they do) these situations can go on for much longer than make sense. But like all things, this pendulum will eventually swing back in the other direction and the reason we regularly monitor the world for potential shifts in trends.

Looking at literally hundreds of charts a week, I am seeing some interesting setups in big cap Chinese stocks such as BABA and BIDU. I wrote about another on Jan 9, WB, which is up more than 30% from the date of that post. You can see in the ratio chart above, it bottomed early last year, testing the .15 level a few times before creating a higher high but eventually falling back to retest that level and failing to start a new uptrend. The good news is the possibility of a reversal is not dead yet. With a divergent momentum low in place as a tailwind, I will be looking for a break above the prior high as my confirmation a bottom and reversal of the downtrend is in place before investment capital is committed to an index of Chinese stocks. Until then, even if we consolidate for many more months and break higher, opportunities in some selective, leading Chinese stocks are looking good and worth an investor’s consideration.