The frontier markets are those countries/economies that are too small and unimportant to be considered even an emerging market. Their kind of like that weird sister you have but fail to mention when discussing your family to friends. Countries like Nigeria, Vietnam, Bahrain and even tiny Mauritius fall into the frontier market bucket. Investing in these markets is extremely difficult as access and liquidity (or lack thereof) are two major risks investors who stick to the “developed economies” don’t have to worry much about.

Besides a limited number of mutual funds there are couple of ETF’s where investors can go to get exposure to the frontier markets, FRN is my favorite. As you can see in FRN’s chart below, it just recently broke out above an important, long-standing zone of resistance. Price is currently above a rising 200 day moving average, momentum is VERY overbought and in need of a rest and likely why price is currently in the process of back-testing the breakout zone. If it were to hold above it, the next upside target would be back at the prior $16 highs some 20% higher. And if the market really gets to rockin’ the prior 2011 highs could eventually be in view, an advance of almost 50%.

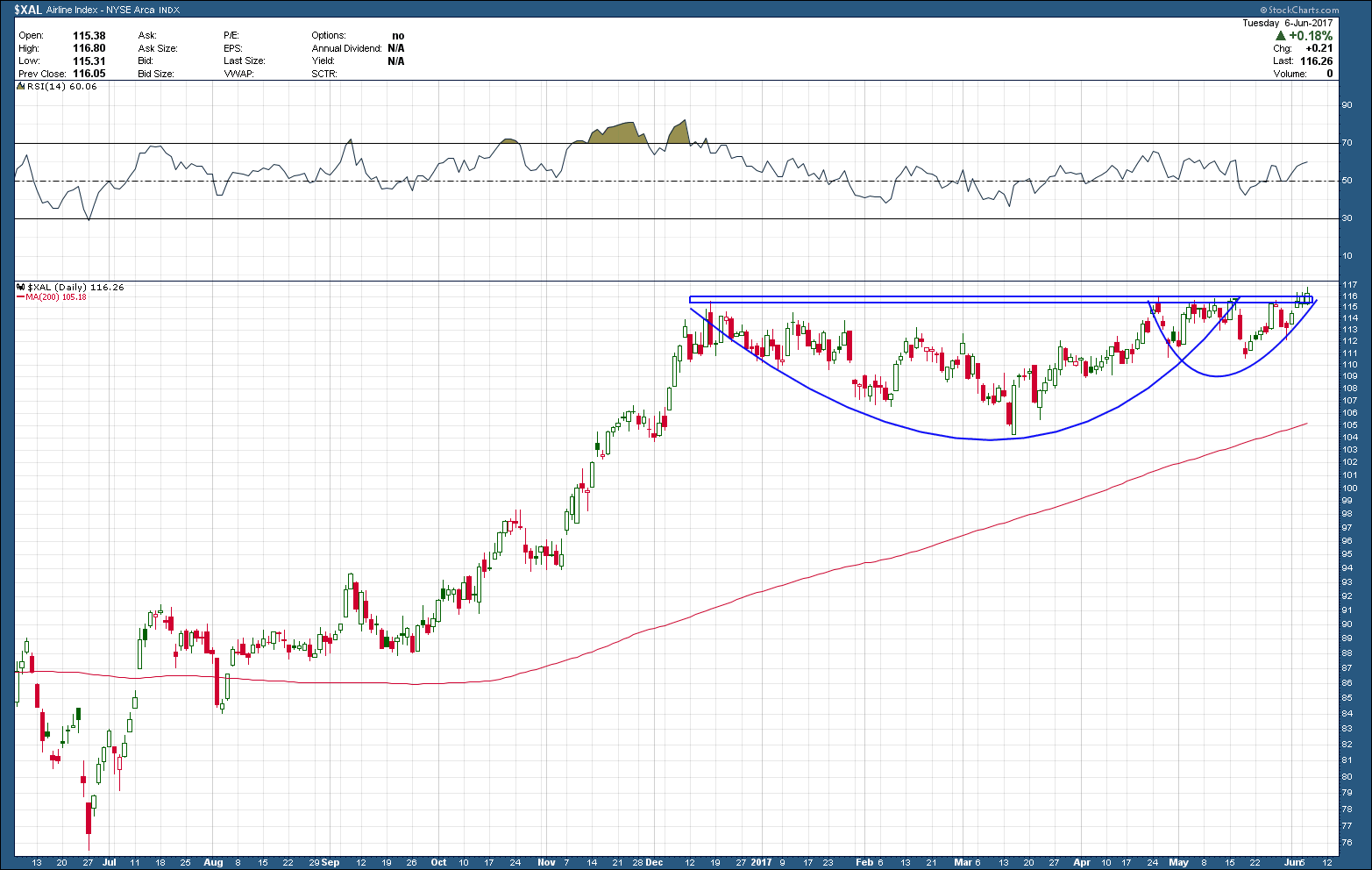

With any alternative investment we want to see its performance as compared to a benchmark before adding to a portfolio. In the second pane from the bottom is the ratio of FRN to the world stock index less US stocks while the bottom pane is the plot of FRN to the US SP500 index. As you can see in both instances FRN has formed a rounded bottom and has formed a series of (slightly) higher highs and higher lows, an indication of a possible trend reversal.

Like the smallest of the small micro-cap stocks, investing in the frontier markets can be a wild ride but offers out-sized gains in addition to a lower correlation and beta to your typical stock index investment. As such, for those with a proper risk tolerance profile, the frontier markets should be considered for inclusion into a well-diversified portfolio.