A quick 3 minute video on where we are with respect to the US stock market.

From the Ashes?

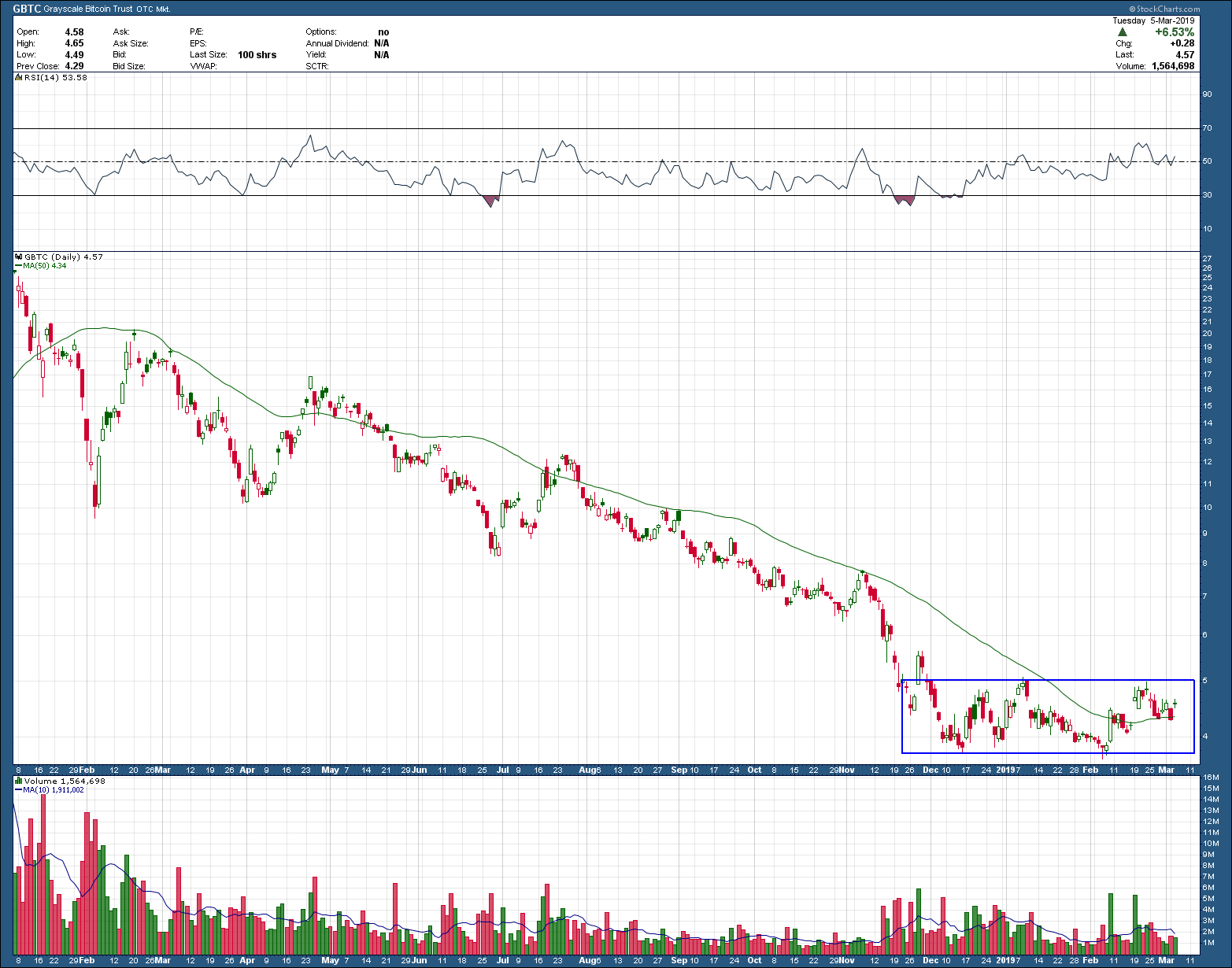

I haven’t written about the Millennial savior, bitcoin, in well, it seems like forever. Not because I don’t like it but rather its was in a horrendous long-term downtrend, losing more than 90% of its value in 15 short months. What’s there to talk about? But, of late its price has taken a much more constructive look as it has been trading sideways (instead of falling further) and looks as it may have found a short-term bottom while trying to clear out the remaining sellers. This, of course, is an ideal setup for a bullish trading opportunity. While it may turn out to be a long-term investment (not my belief), until it proves itself it must be viewed only as a trade.

As you can see, price has been contained within the rectangular box, is now above a rising 50-day moving average while volume (bottom pane) has been shifting from large red candles (selling) to green (buyers). In spite of its potential short-term holding period, the first upside target is ~25% above the upper boundary of the rectangle. Two ways to trade this setup using this pink sheet bitcoin proxy, GBTC, is to buy the breakout of the rectangle, with a stop placed 3% below the breakout level after purchase. The second, which has a much higher upside target (>50%) but has less chance of getting filled, is to place a limit order down at the bottom of the rectangle. If the order gets filled, your stop would be placed 3% below the bottom of the rectangle. In either case, the risk is well contained (likely less than 5% depending upon the price of GBTC gets filled at) and provides either a 25% or 50% potential pattern target reward. A minimum 5:1 or best 10:1 reward to risk is a setup any investor/trader would love to have as they don’t come along that often.

Watching the Transports

A bearish engulfing candlestick pattern is a reversal pattern, occurring at the top of an uptrend. The pattern consists of two candlesticks: 1) a smaller bullish candle (Day 1) followed by a 2) larger bearish candle (Day 2). The bullish candle real body of Day 1 is contained within the real body of the bearish candle of Day 2. On day 2, the market gaps up (typically interpreted as a bullish sign) however, the bulls run out of gas and do not push price very far before the bears take over reversing price down, not only filling in the gap from the morning’s open but also below the previous day’s open. A completed pattern warns of a high probability (at least for the short term) the uptrend is over. The larger the candle body and volume on day 2, the higher the probability of a reversal.

Taking a look at the weekly chart of the Dow Jones Transportation stocks you can see last week closed with that same bearish engulfing candle. Unfortunately for the bears, while last week’s candle did engulf the prior week, it was not overly large. In addition, the weekly selling volume was just slightly above average, nothing out of the norm. If you look to the immediate left at the most recent prior peak in November of last year, it too formed a bearish engulfing pattern where the gulfing candle was not only huge but was confirmed with excessive selling volume. Notice what happened immediately following. This is why you need to take notice when these patterns appear

I have been saying for a couple of weeks the market looks tired but was not yet telling us we had reached the end of this reversion to the mean bounce from last Christmas eve. With last week’s close though, the transports have thrown out the yellow caution flag warning long-term investors to likely expect further selling pressure and short-term traders to cash in their chips or at least tighten stops.

The Return of the Doji

The “doji” (meaning the same or no change in Japanese) can be one of the most important candlesticks when viewing charts. It indicates that buyers and sellers are at equilibrium, a state of indecision and balance. Equality never persists as eventually one side will win, as such investors should desire to be on the side of the winner. When doji’s appear at the end of an extended trend (either up or down) they have the potential to be a significant warning that the near-term trend may be ending. The Japanese (who created candlestick charting) say that whenever a doji appears, investors should always take notice.

The doji is formed when price opens and the closes at or very close to the same level. In Candlestick charting, this essentially creates a “cross” formation. As the illustration below shows, doji’s take on many shapes but all have the same important implication and contain two common elements. A horizontal line which represents the open and close (occurring at or near the same level) and 2) a vertical line representing the total trading range (high and low) during the time period represented on the chart.

Below is a chart of the US Dow Jones industrial index. As you can see, the industrial’s price is approaching the high levels made last November. What should also be clear is that a doji formed Monday. I ask you to let your eyes drift left and look at what happened each time a doji (circled in blue for your convenience) occurred in an extended uptrend. Do you see a pattern that repeats? If so, we all must be wondering if it is finally time to take a breather from this over-extended counter trend bounce off of last Christmas eve’s low prices and expect a pullback? Or will this uptrend be strong enough to overpower the return of the doji?

Your Turn

Those long-term followers know I use ratio charts as a part of my process, mostly to help determine where best to allocate investment capital. As with investment prices, trends persist when it comes to outperformance (ratios). The chart below I call “Risk On” is a ratio of the US SP500 stock index performance to US 30-year treasury bonds and its message helps define current risk levels. If the ratio is rising, risk is low and you have achieved (and will likely continue due to trend persistence) the best return by investing in US stocks only. If the ratio is falling, risk is elevated and bonds are out-performing.

With a quick glance, what should be immediately noticeable is the ratio broke below its rising uptrend support line in November of last year. This occurred at the same time when RSI momentum (upper pane) diverged (both short term and longer term) with the ratio warning of an increase in risk and possible trend change. From that point the ratio was crushed with the strong year-end selloff in stocks.

With stocks rebounding strongly from their massively oversold condition the ratio has, as you would expect, mirrored its move higher. Uninspiringly, the ratio closed out yesterday still below its falling 200-day moving average and has yet to make its first higher low. Looking left we see that the ratio is about the same place it was 12 months ago telling us that stocks and bonds have had a comparative return. Now what?

Closing out this post right here intentionally not providing a summarization or point to the post, I am wondering how you would interpret the charts message? Pile in to stocks gunz a blazin’? Stay on the sidelines in the safety of bonds and let the dust settle? or something in between? I’d love to hear your thoughts and opinions.