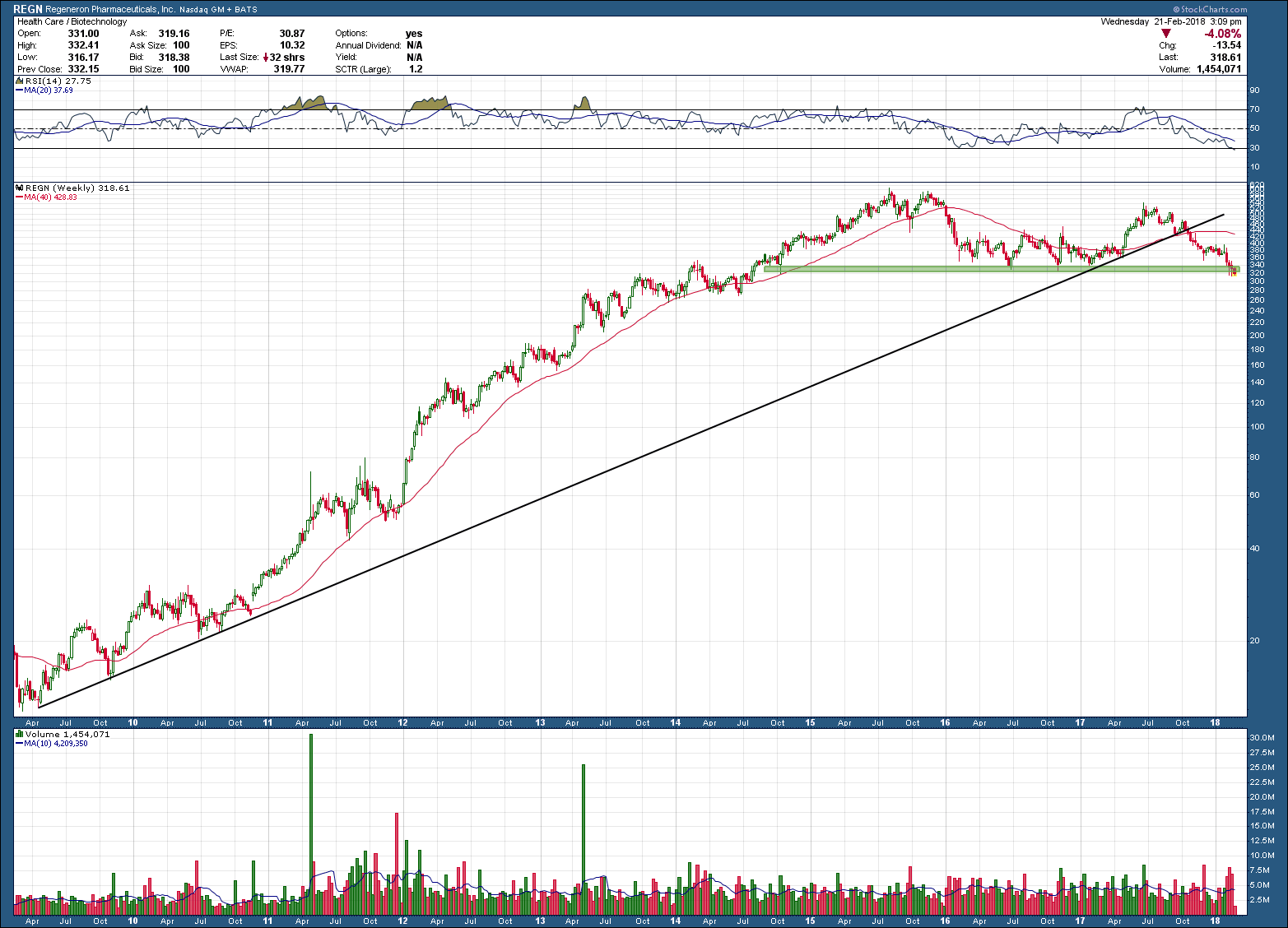

Regeneron, REGN, makes a compelling example of allure of biotech stocks for investors. After breaking out higher in 2009 from a multi-year base, it’s stock went on to post gains of more than 5000% in 5+ years, peaking in August of 2015. Since that time, it has declined almost 50%, something difficult for buy-and-hold investors to experience, unless they got in real early and are still positive on their positions (which only makes it slightly less difficult).

Notice how in 2015 the stock eventually fell below its rising 200 day moving average, bounced off of (green) support and made one more attempt to move higher. That next move higher failed and made a lower high and has now broken below the black uptrend support and once again fallen below (a now falling) 200 day moving average. Price sits at the bottom of support and a continued probe lower and hold below will likely be the trigger that REGN’s uptrend is done (as in put a fork in it) and to expect much lower future prices. Take note and memorize what has occurred as this is a classic long term topping pattern that most all investments mirror when their bull run eventually ends.