Monday’s 2.4% drop in the SP500 was a punch to the gut for investor’s account but when put into perspective of “worst days” for the index since its inception, it was nothing but an average day at the office.

From False Breaks …

One of the first adage’s I learned from one of my TA mentors was “from false breaks come big moves”. It’s supposed to be a catchy phrase about the potential for big moves in the opposite direction when price breaks out of an area of previous resistance (which now becomes support), moves higher and then reverses back below that prior resistance / (what has now become) support line. A good example of this occurred in US stocks last year as depicted in the SP500 index chart below.

As you can see price broke eventually above the blue horizontal prior high level. Moved higher for a few weeks then reversed course and fell back below the prior breakout level. What came next, we all know, was our ~20% decline in stock prices that ended on Christmas eve last year.

With the TrumpTrade volatility dominating the markets of late, it is interesting to see the SP500 has fully recovered and moved back above last Sep 2018’s high (see below). But what is more interesting is to note the SP500’s price ended last week right back on the breakout level. If further volatility is ahead, it could be expected we see the SP500, once again have a second failed breakout.

Of course nothing works 100% of the time, but the “from false breakouts” adage should still be front and center with investors at this time in case the markets want to repeat last year’s false breakout sharp decline.

Round 2?

I have written many times about the appeal of investments that are breaking out from a consolidative base. Often times, depending upon whether there is a pattern formed within that consolidation, it can provide a target price for that breakout move. Keep in mind, targets best used solely as a way for investors to calculate and manage risk, definitely not a guarantee. But, if they eventually meet their target, many times it is not the end of the move … it could be just the beginning. It all depends upon price structure at that time.

Recycling the bitcoin chart GBTC from my April 10th follow-up blog post, the breakout from the consolidative base led to a quick 40+% gain, peaking just slightly above its target, T1. Initial breakout targets also provide information about where the next level of consolidation is likely to occur, if the target is achieved. Back to the GBTC chart, right on queue it did exactly as expected after acheiving its initial target, it began to consolidate and has been doing so for 3 weeks. That consolidation has allowed the froth to unwind and allow those that wanted to sell, the opportunity. What I never talk about with breakout opportunities is the possibility the initial breakout being the start of a much bigger move. Something that would extend much further than just the first upside target. In the case of GBTC, this seems like a real possibility. During the recent consolidation after reaching its intiail upside target, GBTC has formed another bullish pattern which points to an even larger upside target, T2, if the pattern should confirm. Confirmation, of course, is validated through a gap or strong move above the pattern’s neckline (green horizontal line) with volume that is significantly greater than its current average. A back-test and hold of the neckline after breakout would be welcomed and provide investors who missed out, an excellent, low risk chance to enter a position and get involved in round 2 of what looks to be a continued bitcoin run

Lyft Off?

Long term readers know my distaste for buying IPO’s. It’s only because historically those that initially buy an IPO will only make money if they trade it. 99% of investors don’t know how to trade so it usually ends up badly because IPO’s are all about hyping a known company, drawing in the dumb money so the smart money (the initial investors and the bankers bringing them public) can get out. This is why you typically see a ramp up when a company initially goes public and then the stock price comes crashing back to reality. Not always …. but most of the time and the reason to make money on IPO’s, you need trade rather than buy and be a part of the crash.

The better strategy is to wait until the stock price falls back to earth and then buy, assuming it is a company worth my investment capital. The recent IPO, LYFT is a good example of what occurs. The major difference between LYFT and most other IPO’s is LYFT never got the initial buying boost as it peaked on first day of being public and has fallen almost 40% from peak to trough since. This is a rare occurrence for IPO’s but make sense when you consider how over capitalized the company is. Its long-term prospects may be good but a company making no money, has competition everywhere and a market capitalization of more than $20B is, shall I say it, overvalued.

As a for-profit investor it doesn’t mean the stock should be ignored, especially if it presents a price dislocation and is setting up for a potential directional change to the upside like it currently is. Taking a look at the shorter term, 2-hour chart of LYFT below, you can see it has formed an inverse head and shoulder reversal pattern during its recent sideways consolidation. This is a constructive setup if it breaks, holds and confirms above its neckline as it presents an upside target near April 11ths highs, a 15%+ gain.

While I really like this setup as the risk to reward is excellent and as such took a few shares in my trading account early before any breakout occurred, I do want to warn potential followers the company announces earnings next week on 5/7/19. As a general rule I prefer not to hold shares into earnings but will under 2 conditions 1) if I have enough cushion in my entry price to give a high probability of a profit on the investment if poor earnings cause the stock to fall and I get stopped out and 2) if my position size is small enough to ensure a small and contained loss if earnings should cause the stock to fall. Either way its all about risk management.

3 More Months? No problem

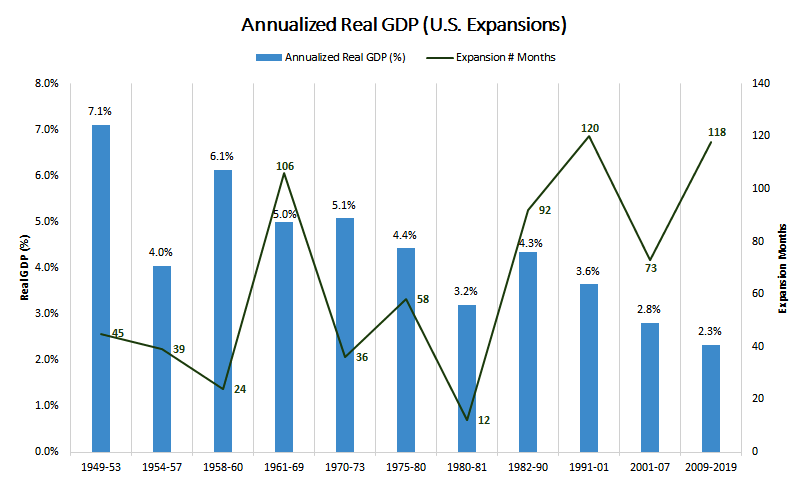

If we can add another 3 months of economic growth, the US expansion from the 2009 financial crisis bottom will exceed the longest in history. What makes this most interesting is that while it will likely turn out to be the longest expansion, it is on target to also be the weakest in history (annualized GDP)