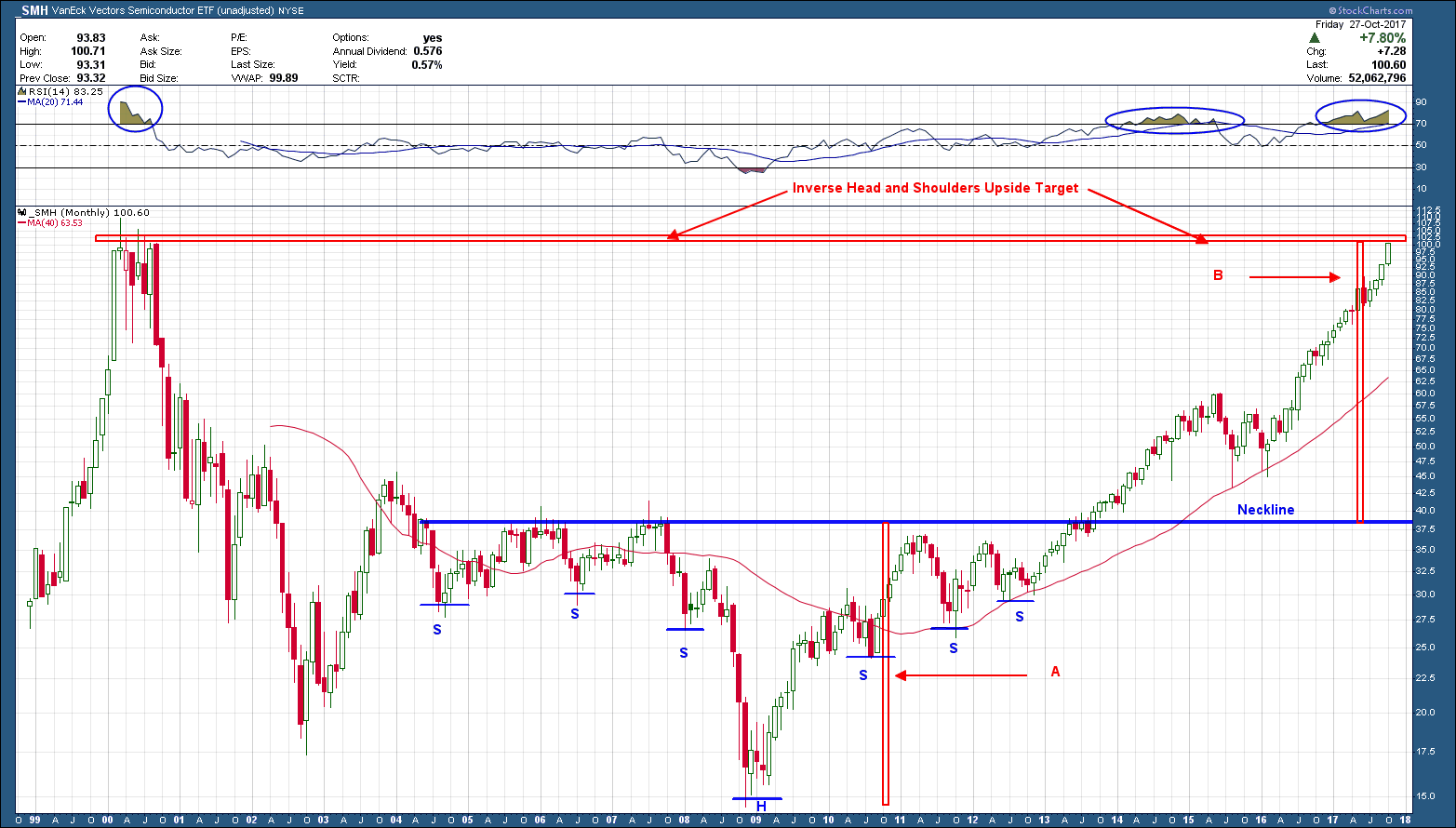

After falling more than 85% from its 2000 peak, the Semiconductor ETF, SMH, finally bottomed in Q4 of 2008. On its rally back from the low, it formed an inverse head and shoulders bottom reversal pattern as you can see in the 20-year monthly chart of the ETF below. The measured target from any H&S pattern is the distance from the head to the neckline added to the neckline. In this case the vertical bar “A” is the distance from the low to the neckline, while bar “B” is just “A” added to the neckline. Its interesting, but not unusual, for these pattern targets to end at or very near prior important levels. In this case the pattern target fell right at the 2000 high. The exact high this ETF has EVER reached. Prior highs usually act as resistance and provide a headwind to higher prices. Most of the time price will either take a breather and consolidate (like 2015-2016) or reverse course (like it did in 2000).

I have cleared out the chart to include only the price of the ETF in the bottom pane and one indicator, RSI momentum in the upper pane. RSI momentum above 70 is considered an overbought condition, which has occurred only two other times over the past 20 years. Overbought conditions are not sell signals (no signal from an indicator is as it must be confirmed by price) but rather the sign of a very strong market.

When more than one signal from different indicators appear with the same message in the same price area like we have here, the message should be given more significance. As such I would expect semiconductors, as a minimum to take a breather in this area. Because each candle on the above chart is equivalent to one month it could take many months for a breather or something worse, to register its intent. On the flip side, if price does not consolidate, we are clearly in such a strong market that a confirmed break higher would be an important buy signal to consider if one was not already an SMH owner.