Pocket Pivots

The pocket pivot concept is, in essence, a favorable early-entry buy point in a stock. Buying pocket pivots are advantageous because the signal attempts to get investors into stock early and often times before it has broken out of consolidation. Stocks alternate between trending and consolidation and an area of consolidation provides an investor an excellent time to enter a stock early in preparation for the next move higher. It also allows investors to add to existing positions in a winning stock, if they so choose, as trending stocks often have multiple pocket pivot points as they move higher.

The basic premise of the Pocket Pivot:

Institutional buying creates new-high base breakouts, but we also know that institutional buying occurs within consolidations and during uptrends.

This buying within consolidations and uptrends in most cases leaves price/volume "footprints". These footprints are big volume spikes, typically 50% or higher than the normal average daily volume.

The pocket pivot describes that "footprint," and provides a clear, buyable "pivot point," or "pocket pivot buy point."

Pocket pivots also provide a tool for buying leading stocks as they progress higher within uptrends, extended from a prior base or price consolidation.

Prices of stocks cannot trend (higher or lower) unless there is institutional activity. The average investor does not have a pile of capital large enough to move the markets, only institutions do. As such, it can be profitable mirroring their movement, which is visible via big volume. No different than tracking elephants. Just look for the big footprints and big piles of ….

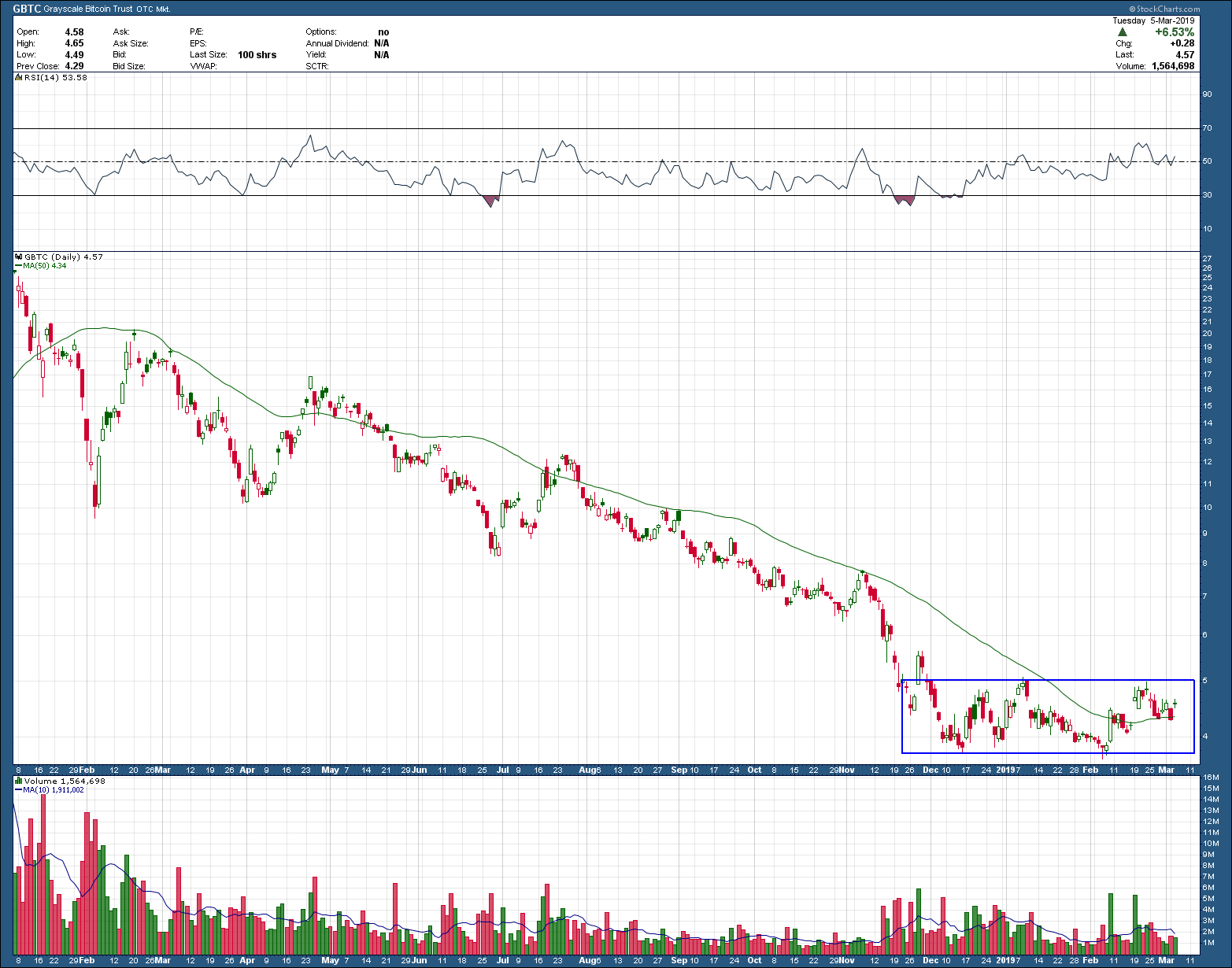

Pocket pivots can occur at any time but not all are a buy signal. To increase the probabilities of a profitable outcome, I have found that buying only during (or a breakout of) consolidations provide the highest winning probability.

A good example of pocket pivots can be seen in the AMD chart below. Those that I have annotated were the only ones that met my criteria. Notice that today, AMD registered a pocket pivot buy signal yesterday (note the big volume and break out of the area of consolidation), moving higher by more than 11% on the day. 152M shares traded vs the 10day average of 49M which is a confirmation of accumulation by institutional investors. The good news for is that our core+ accounts purchased AMD earlier in the year during the first pivot breakout. Its been a frustrating few months during this sideways consolidation but our patience has been rewarded. Upside targets are above at T1, T2.

As always when it comes to investing in anything, YMMV.