According to the U.S. Department of Health and Human Services, almost 70% of Americans turning 65 today will need some type of long-term care (LTC) as they age. And 20% will likely need care for five or more years. Given that the annual cost of that care can extend into six figures, that’s a daunting prospect for many retirees.

There’s no way to know for sure whether you’ll need long-term care, but if you do, it could jeopardize your retirement savings if you’re not prepared.

For decades, purchasing a long-term care insurance policy has been a common solution. But many insurers—facing lower interest rates and higher claims payouts—have raised their premiums or stopped offering the policies. So, the long-term care industry has developed a variety of new options that may provide more appealing coverage, given your needs and overall financial plan.

A new era of long-term care insurance

Traditional LTC policies (in addition to their increasing expense) are typically “use it or lose it” products, similar to homeowner’s insurance. You might pay premiums for years without ever needing coverage—and never get your cash back.

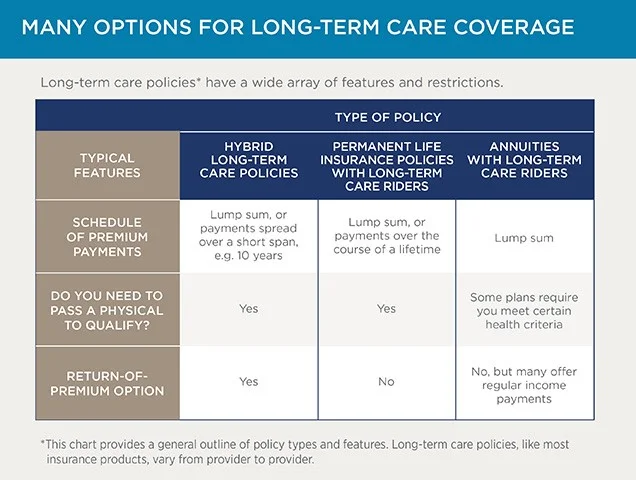

There are newer LTC policies, however, that are different. They’re often combination products that provide either a life insurance or annuity component and may allow premium returns. Here are three common types of newer long-term care policies, with some advantages and drawbacks.

Source: Schwab

1) Hybrid long-term care policies merge traditional long-term care insurance with life insurance, while offering a return of the premium.

The advantage of a hybrid policy is that it offers a benefit whether you need long-term care, pass away, or discontinue the policy and want your premiums back. That said, this type of policy also comes with drawbacks, including how the premiums are paid, as well as a higher bar to qualify for the coverage.

Hybrid plan premiums are typically paid in a lump sum, or spread out over a short period of time (10 years, for example). And because you’re paying for life insurance as well as LTC coverage, plus the return-of-premium feature, the cost can be prohibitive. Also, because this option bundles two products in one, you’ll need to qualify for both coverage types in order to get a policy.

2) Permanent life insurance policies with long-term care riders enable a percentage of the death benefit to be used for long-term care costs.

These policies can offer some payment flexibility—allowing lump sum premiums or annual payments over a lifetime. And their costs tend to be lower than other types of combined coverage.

The drawbacks? The policies don’t offer the return-of-premium option and the terms of reimbursement can be stringent. For example, with these policies a doctor must attest that your inability to perform basic activities is permanent—which could seriously limit the benefits you receive. For a traditional or hybrid LTC claim to be paid, on the other hand, you typically only need a doctor’s validation that you cannot perform certain activities of daily living (or that you’re cognitively impaired).

Similar to the hybrid policies above, applicants must also qualify for both life insurance and the LTC rider.

3) Annuities with long-term care riders have terms that are similar to those of fixed annuities. You typically purchase the annuity with a lump sum and receive a monthly benefit. In some cases, no extra cost is incurred for the long-term care component because it’s funded by the annuity premium.

For example, you can buy a deferred long-term care annuity with a lump sum premium. The annuity creates two funds: one for long-term care expenses, the other for whatever you choose. That said, the terms of the annuity dictate how much you can withdraw from each fund, and the tax implications can be complicated.

Given the complex terms of some annuity products, you may want the advice of a tax professional when exploring this option.

What to know, what to ask about LTC coverage

Buying LTC insurance can be an exacting process, but one that’s well worth it. In addition to examining the payment and coverage features, be sure to evaluate the insurer’s reputation and financial strength. And when comparing options, make sure to ask the following questions:

- What sort of inflation protection does the policy offer?

- Are there limitations on preexisting conditions?

- Is Alzheimer’s disease covered?

- What is the lag time until the benefits kick in, and how long will they last?

- How often has the insurer raised rates?