The national personal saving rate is less than 5%, according to the Federal Reserve Bank of St. Louis — and that’s just not enough. Putting away even 5% of income each year in hopes of building a sufficient retirement portfolio won’t get the job done, even if people start saving for retirement as early as 30.

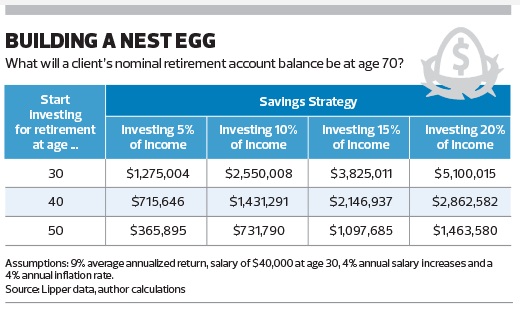

Let’s run the numbers, taking as an example a 30-year-old who currently makes $40,000; we’ll assume that salary will grow at 4% each year until retirement. If she saves 5% of her income each year, and her investment portfolio has a 9% annualized return before retirement, she will have just under $1.3 million (in nominal terms) saved by age 70.

Of course, the more you save, the bigger your nest egg – double the amount you sock away and your pile triples over the same time frame.

But even more important is that the earlier you start the better off you‘ll be. Notice that delaying savings by 10 years nearly halves your nest egg at all savings rates!

So how long would this money last you in retirement? That will be the subject of next week’s post.