In spite of Friday’s ugly close, the bulls took control of the market last week as the SP500 gained a bit more than 1.5% and closed above major resistance.

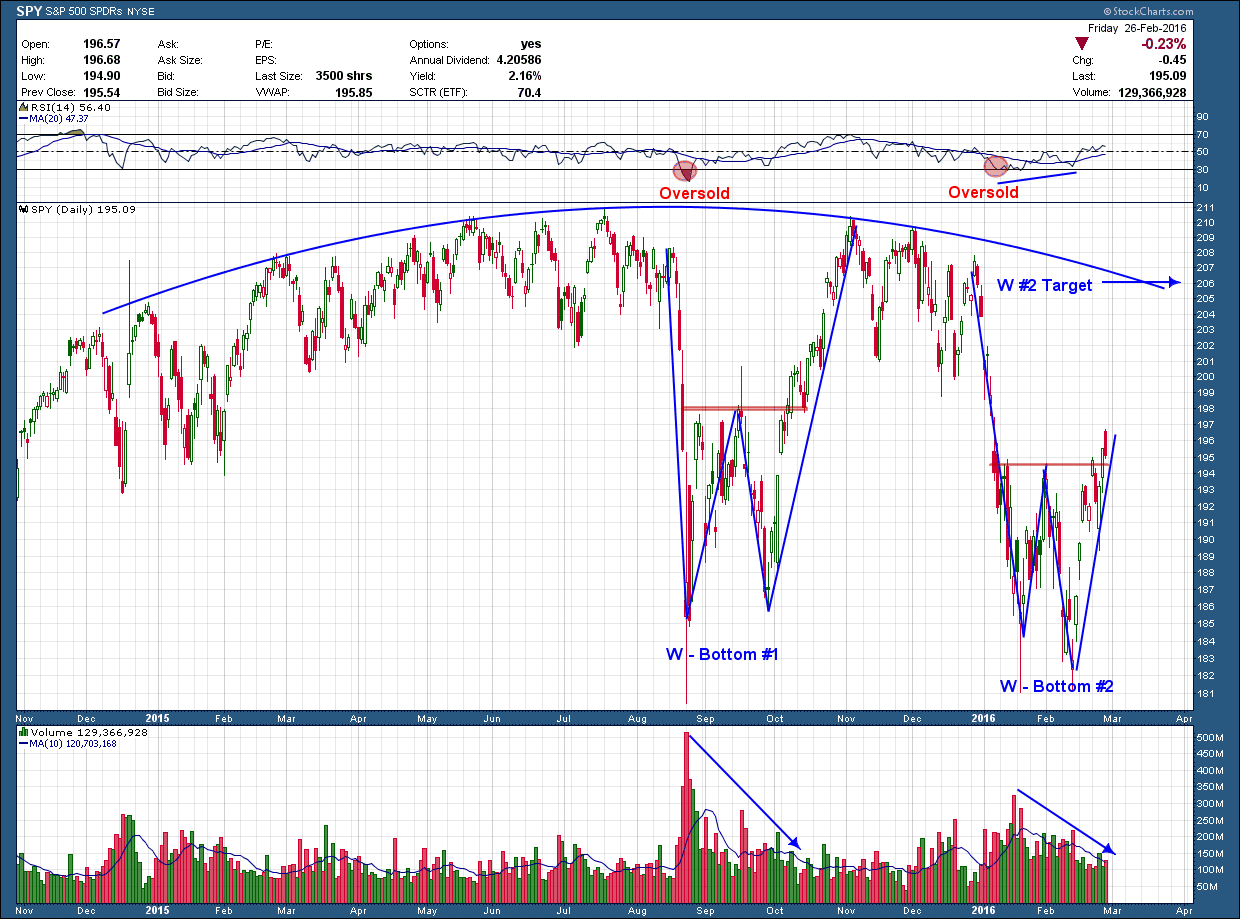

I talk about patterns repeating themselves and wanted to use today’s post to point out an example that is unfolding in front of us right now in the US broad market index. Notice in the chart below of the SP500, the first correction that started in August of last year formed a W bottom. The first leg of the W created an oversold condition in RSI momentum. The upside target of a W pattern once confirmed is the height of the W underneath the (red) neckline added to the neckline. Using the right leg of the W to calculate the target, price eventually came within 5 cents of hitting its target. Once the target was hit price began to consolidate. But notice that during consolidation, instead of making higher highs like it did to during the consolidation (reflecting strength) to the left of the W, price struggled as each successive high was lower than the previous. A sign of weakness

Eventually strong selling again overtook the market and the second correction began in earnest as we welcomed in the New Year. Like the first correction, this one formed another W bottom. A couple of significant and important differences that needs to be pointed out with this W is

1) The bottom of the pattern started from a lower point and

2) The second leg of the most recent W pattern started from a lower point than the first leg whereas the in the first W, the second leg started from a higher point than the first leg. Again, another sign of weakness

On a positive note this week, price broke out on higher volume and closed above its (red) neckline. If the bulls retain control I would expect a repeat of the path of the first W and we move higher. I have indicated the target of where that pattern projects but expect it to fall short of fully reaching it. Even if it reaches its target or slightly beyond as long as it stays below the end of December's high, it will again have made a lower high which is confirming the thesis we are in a downtrend and caution is warranted as we would expect to see lower prices later this year.