A good market technician will ignore all the fundamental arguments of why an investment should go up or down and focus solely on price. The basis for this is that all “fundamentals” should be built into the price of an investment. In today’s world where information is available, almost instantaneously in fact, this reasoning has a sound foundation. I have been preaching fundamentals for years and have found out while they do matter in the long run, the short term on-the-other-hand can provide a completely different outcome. Starting with no bias or fundamental beliefs, thus weekend I took a long term look at two US stock indexes, SP500 and the Nasdaq and the results surprised me.

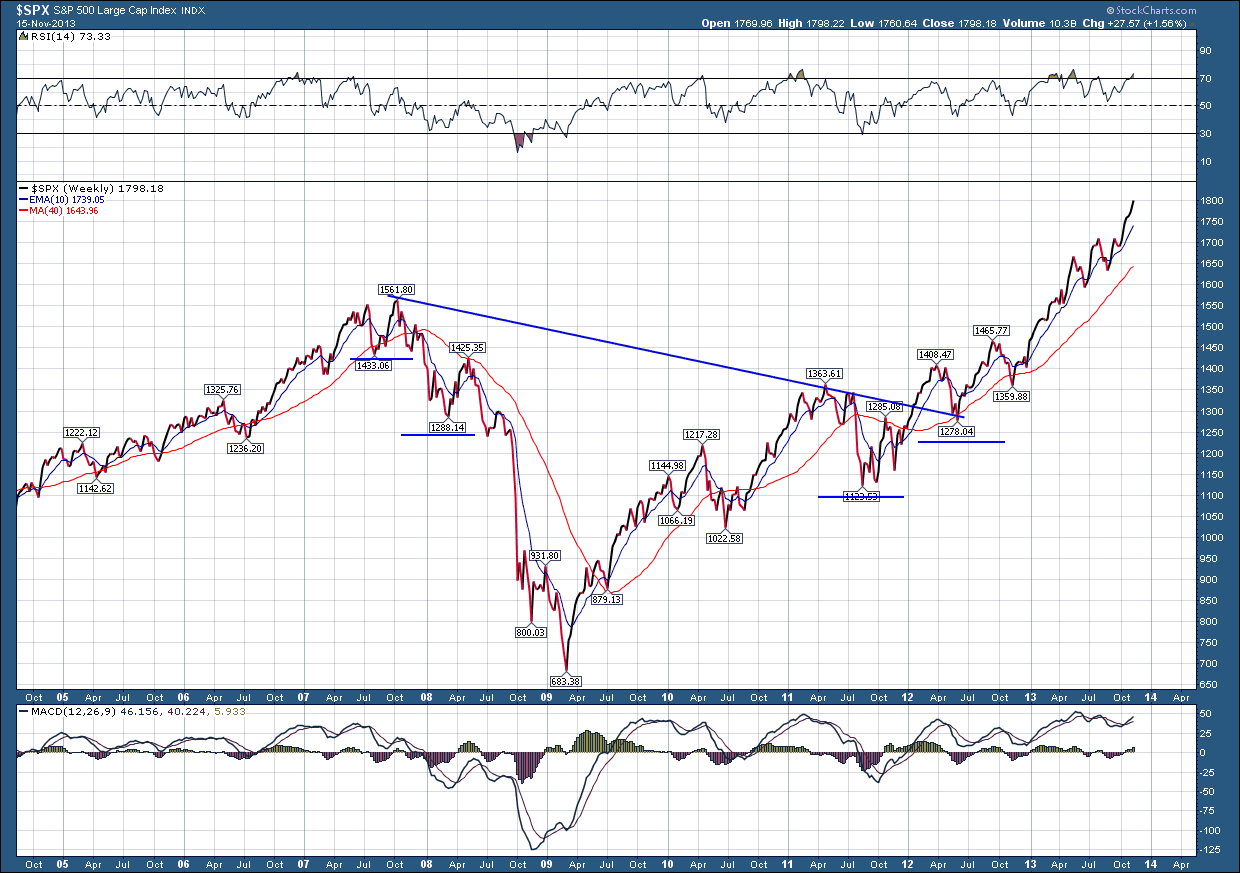

Below is the SP500 index sporting a very nice looking slanted inverse head and shoulders pattern which has a projected target of 2111, which is an increase of 19% from last Friday’s closing price

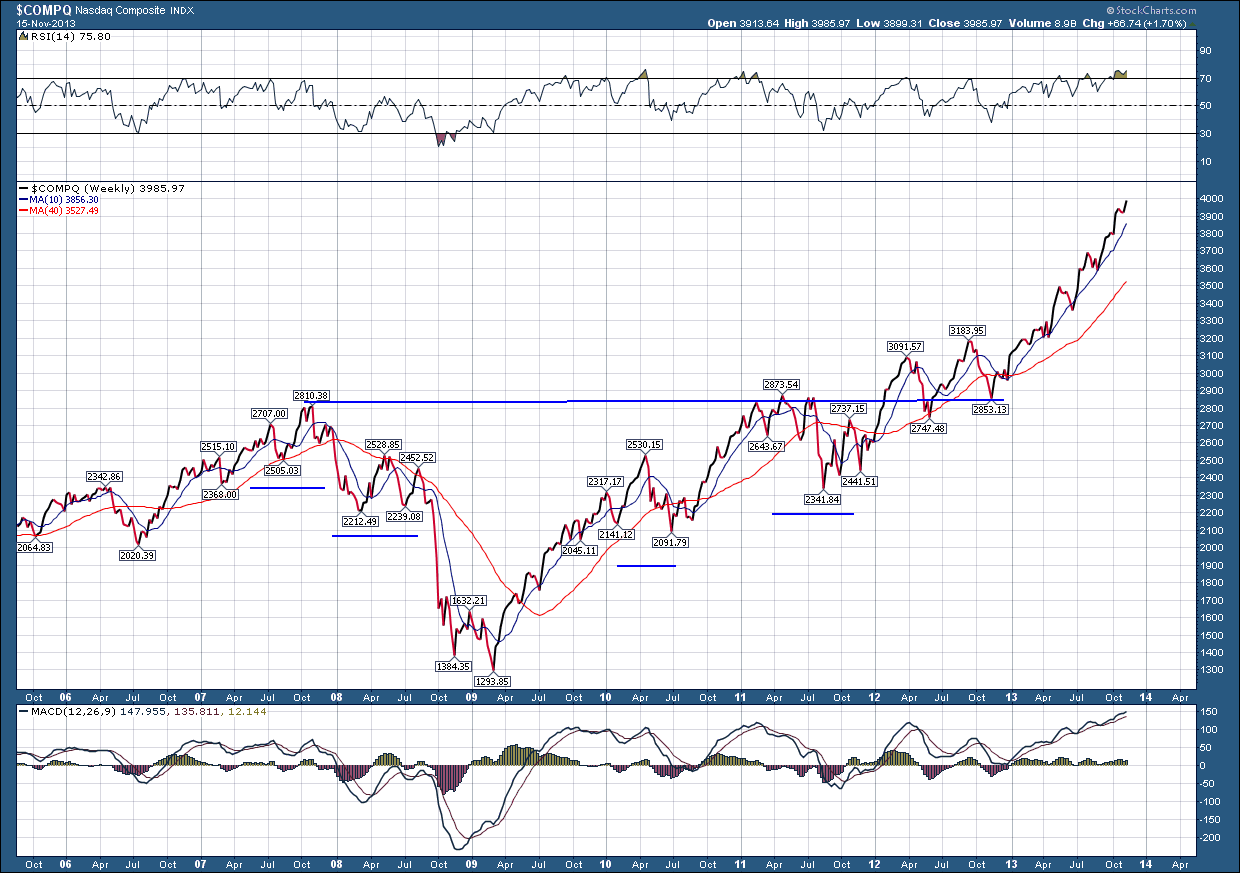

The NASDAQ has the exact same setup but a projected target of 4433 which is 11% higher from here.

While I am by no means predicting the future, I wanted to take an objective look at “possibilities” for the chance for further upside and if it existed, how much further. What I discovered is the market has much more upside than I thought possible, so I need to adjust my views accordingly. By no means if we push higher and hit my targets or even go beyond do I believe it will be a straight moon shot there. I would expect to see the normal ebbs and flows of prices with the possibility of a short term correction (10% or less) between now and then. In spite of the gamut of negative fundamental arguments (most of which I have addressed before), price says we have more upside.