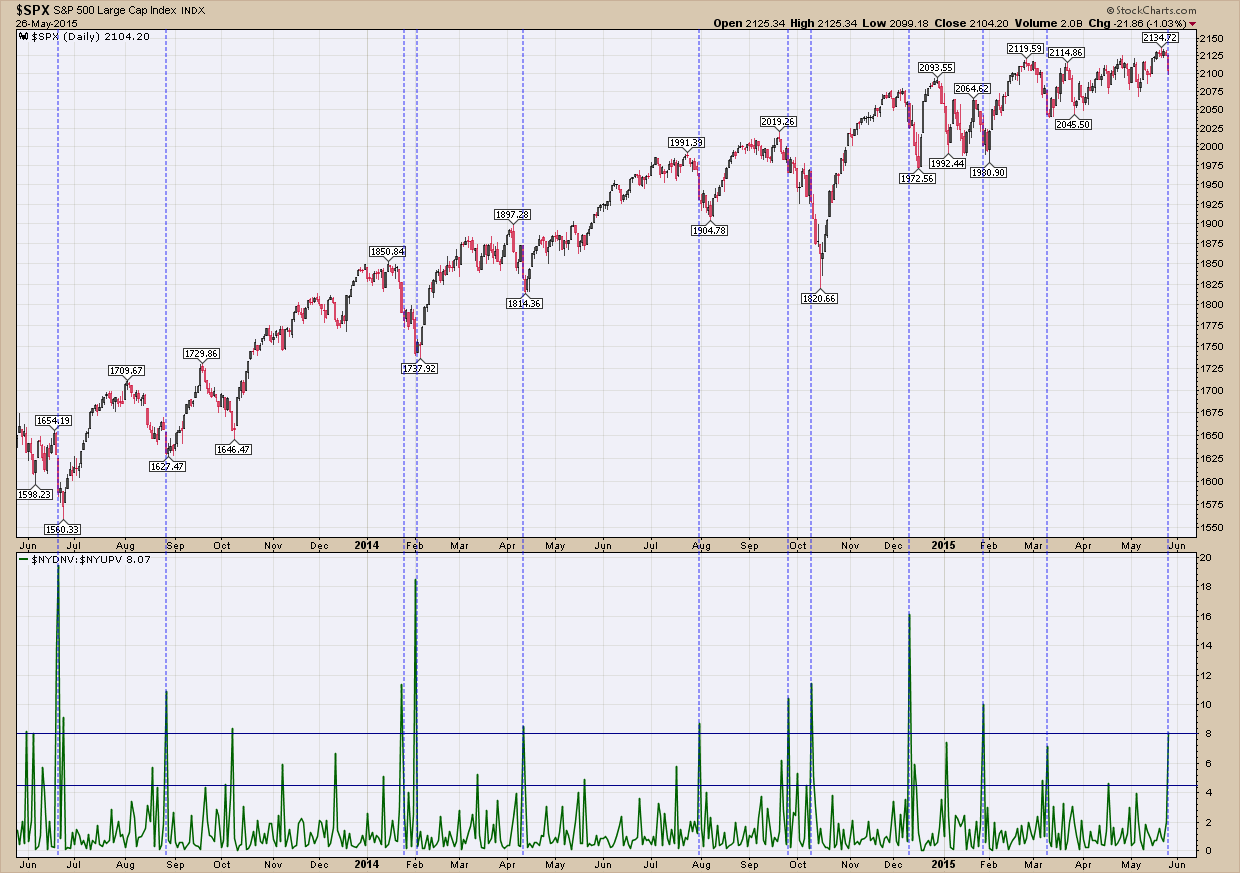

Today was an ugly day in the markets as stocks dropped, volatility gapped 16% higher and bonds had one of their best days in a long time. While there are some very disconcerting fundamentals underneath the hood of the US stock market, to put this day in perspective we are only off 1.3% from all-time highs. But because this is the Jason Bourne market (always an eye on the exit) every time these days occur I check my indicator charts to see if they can give me any insight. One indicator I like to look at first is what I call “volume capitulation” which have presented below. Simply, it tries to identify bottoms during short term corrections by analyzing selling volume. What you see is that at or near the end of a correction everyone that wanted to sell did so (capitulation) and as such the market reasserts back into its uptrend. By looking at volume and selling patterns you can recognize the signs of capitulation. In the upper of pane of the chart is the price of my proxy for the US stock market, the SP500. In the bottom pane is the result of dividing the volume of shares on the NYSE that traded lower by the volume of shares of stocks that traded higher. Logically you would expect on days of capitulatory selling this ratio would be large. In fact that is exactly what happened today as there was more than 8x the down volume as up. What makes this number interesting is that in the past when this ratio has gotten above 8 (I have highlighted these occurrences with blue dashed vertical lines) it has been a pretty good indicator of exhaustion selling and that a bottom was near. While it is not perfect in picking THE bottom (it turns out to be early in most cases), it does provide a nice early warning that a bottom is likely just around the corner. Will this time be any different?