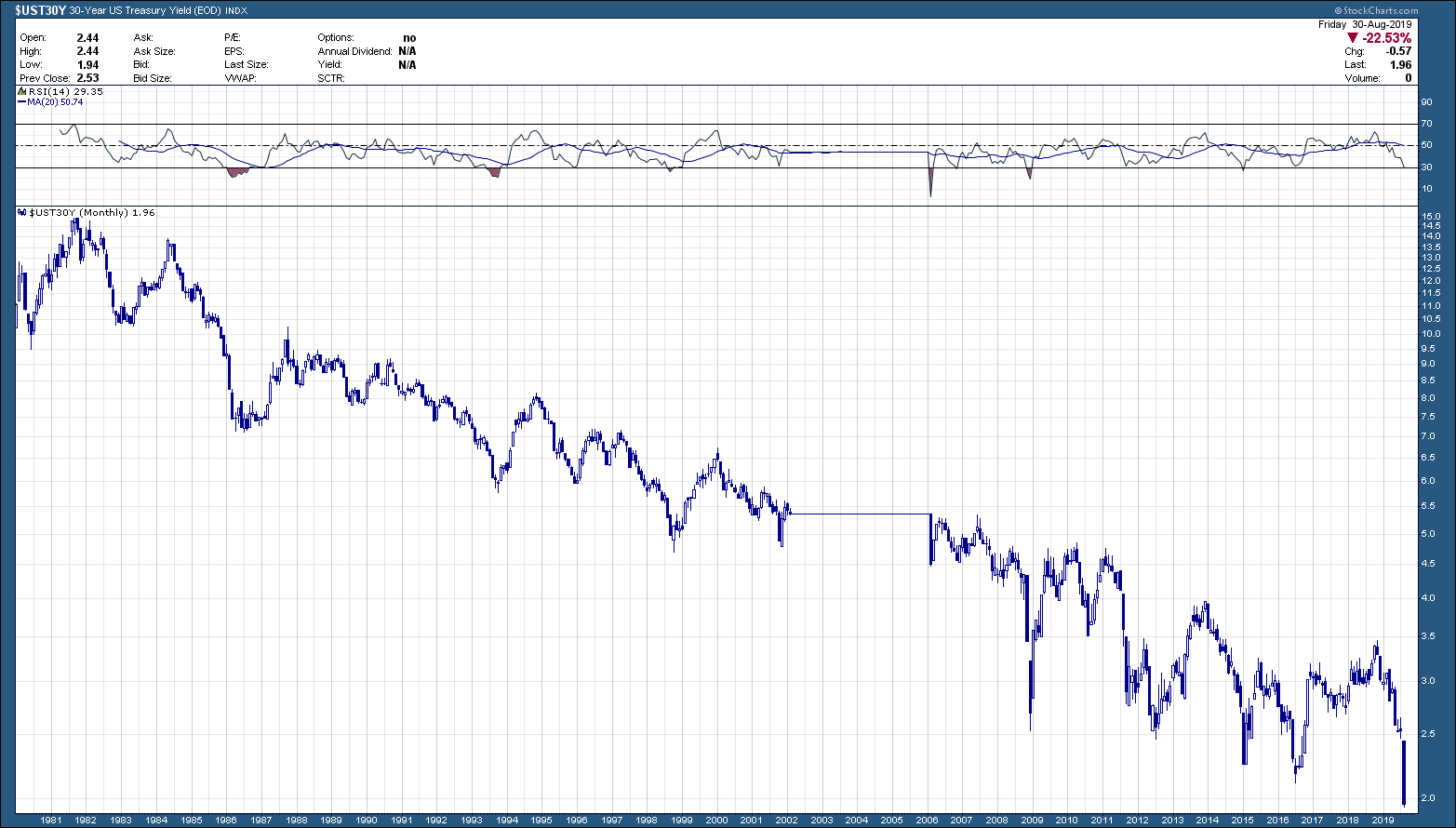

Friday’s close, August’s final trading day, marked the lowest close for US 30-year Treasury bond yields. Ever.

Long-term US Treasury yields printing all-time lows cannot be ignored. It is sending a message. It has, at times in the past, been a great harbinger that an economic slowdown will be likely sometime in our future. But at other times it’s signaled fear from an external event and the subsequent rush to safety. US Treasuries are considered the safe haven and where investors stash their cash waiting for markets to settle down. Just thinking out loud in an attempt to provide another reason, if I were a foreign investor and needed to park some money where it is guaranteed (let’s avoid the guarantee discussion for the sake of keeping the blog civil), US treasuries are about the best answer. At least for now. While a yield less than 2% is just about as unappealing as listening to Rosanne sing the national anthem, it sure beats most every other sovereign bond offering around the globe. As we know, most of Europe is now charging you interest to lend them money rather than giving it. Large inflows into US Treasuries drive prices higher and yields lower. If you are looking for certainty here as to what the exact message is, you’re going to be sorely disappointed. Unfortunately, the exact message will only be known in the future because it will be so obvious in hindsight. What the message should be used for is the same message you would get if you walked down a dark alley alone, at night. Raise your awareness and have a plan.

The other thing that cannot go without mention at this time of all-time low yields is to continue to highlight the devastating impact low yields have on pensions. When yields fall and stay low, the biggest losers, besides savers are pension funds. Why? because they are required, by law, to hold some of their retirement investments in the “safety” of US Treasuries. All pensions use returns of 7-8% (some foolishly have used higher and are in deeper trouble or already defunct because of it) to project and pay the future benefits to their participants. In order to earn a long-term pension return of 8% with 2% treasury yields, the stock portion of their investment holdings will need to return 12-14%. Every year. Forever … well at least as long as the pension survives … or they cut benefits. What do you think the likelihood of that happening is? Exactly. And why the pension crisis is not a matter of if, but when. I have no doubt, there is still ample time but smart pensioners should be finding a way to eventually live on less.