The short and intermediate fundamental term outlook for oil prices continue to look weak as demand falters and supply continues to be robust. Just last month the International Energy Agency provided the following bearish backdrop forecast for future oil prices:

“The surplus in global oil markets will last for longer than previously thought, persisting into late 2017 as demand growth slumps and supply proves resilient. World oil stockpiles will continue to accumulate through 2017, a fourth consecutive year of oversupply.”

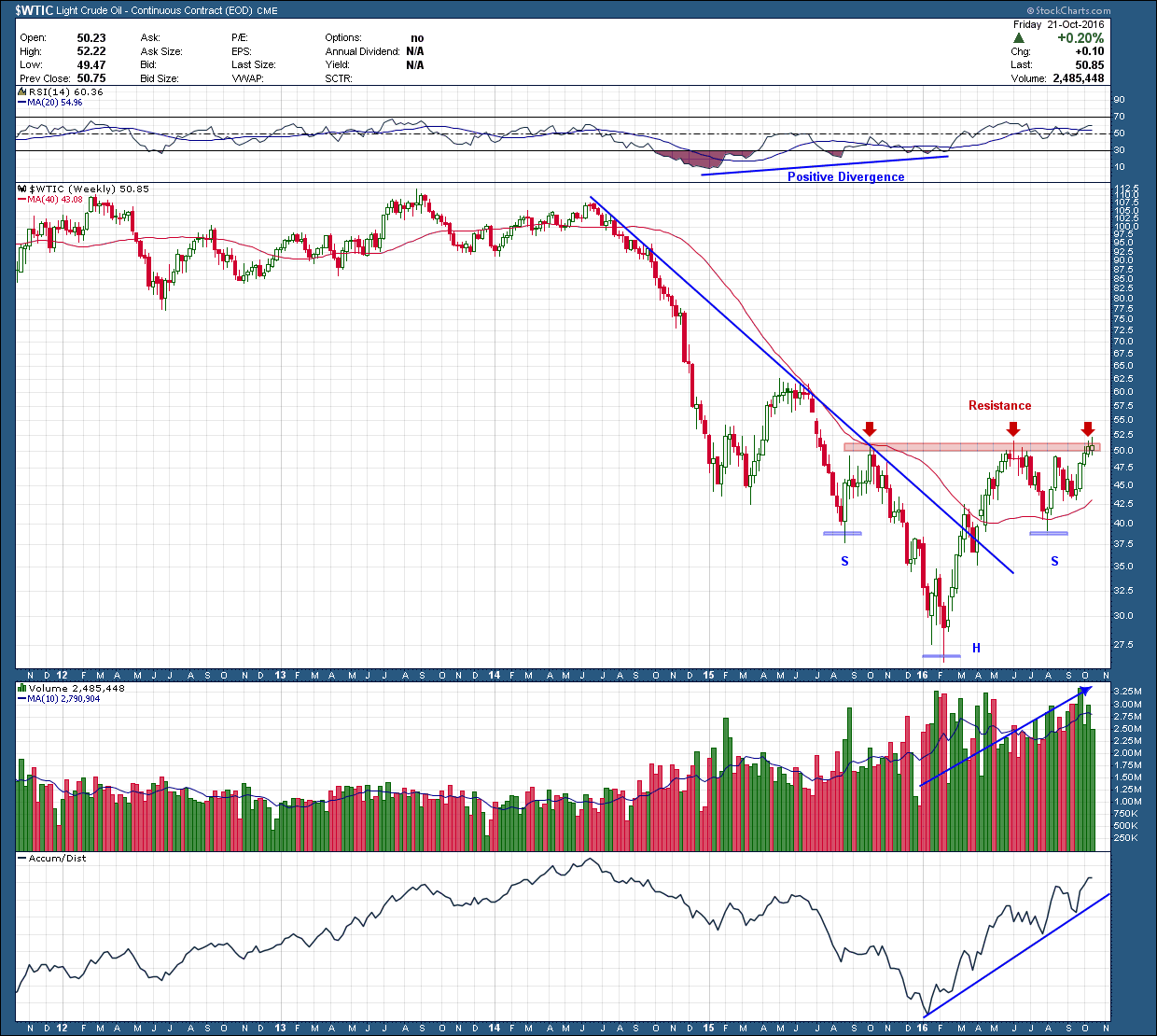

And yet I can hardly find a more bullish chart than that for oil. The 19 month, 75% (peak to trough) drop in price, came to an abrupt end in February of this year. Notice how, during the decline, positive divergence formed in the upper RSI momentum pane on each successive low. After putting in a hammer candlestick bottom on Feb 16ths close, price reversed strongly and powered higher, pausing for a brief breather just after piercing the blue downtrend resistance line and eventually peaking at the logical ~$50 (prior resistance) level.

After a healthy correction off $50, oil is once again to break through critical resistance. As bulls want to see, both volume (3rd pane) and the advance/decline line (bottom pane) have been increasing from the Feb. bottom confirming the strength and legitimacy of the move. Additionally, price is holding above a rising (red) 200 day moving average. Hopefully your eyes are becoming trained to look for patterns and were able to notice, without the aid of my annotations, the inverse head and shoulders bottom that if confirms and plays out to its target, projects to the $75 level.

Investing is so much easier and provides greater success probability when the stars and planets (technical and fundamentals) are aligned. But since this is not the case here what is an investor to do? Depending upon your risk tolerance one option would be to move on and wait for the ideal setup where all signal align. Another would be to wait for confirmation and jump on the opportunity but manage risk via both a reduction in position size and loss acceptance (exit strategy). Whatever your style, the markets rarely provide “slam dunk” opportunities and when they do you’ll often find Ms. Market is playing you.

“If you can’t find the sucker at the table, you’re it.”