Can’t you find something different to write about, Chuck?

I received an inquiry on what my thoughts were on buying Apple stock right here and I thought I would put them into a blog post because Apple is a great proxy for the broader indexes. And because the market is at a crossroad however Apple goes, so goes the rest of the market. Or so they say.

I know this post is bad timing being that the FED FOMC is later this morning and most likely whatever they say will drive the markets, potentially trumping what is in the charts. Even if the markets don’t get rattled as I expect, the analysis is still worthwhile as it can be used as a learning tool.

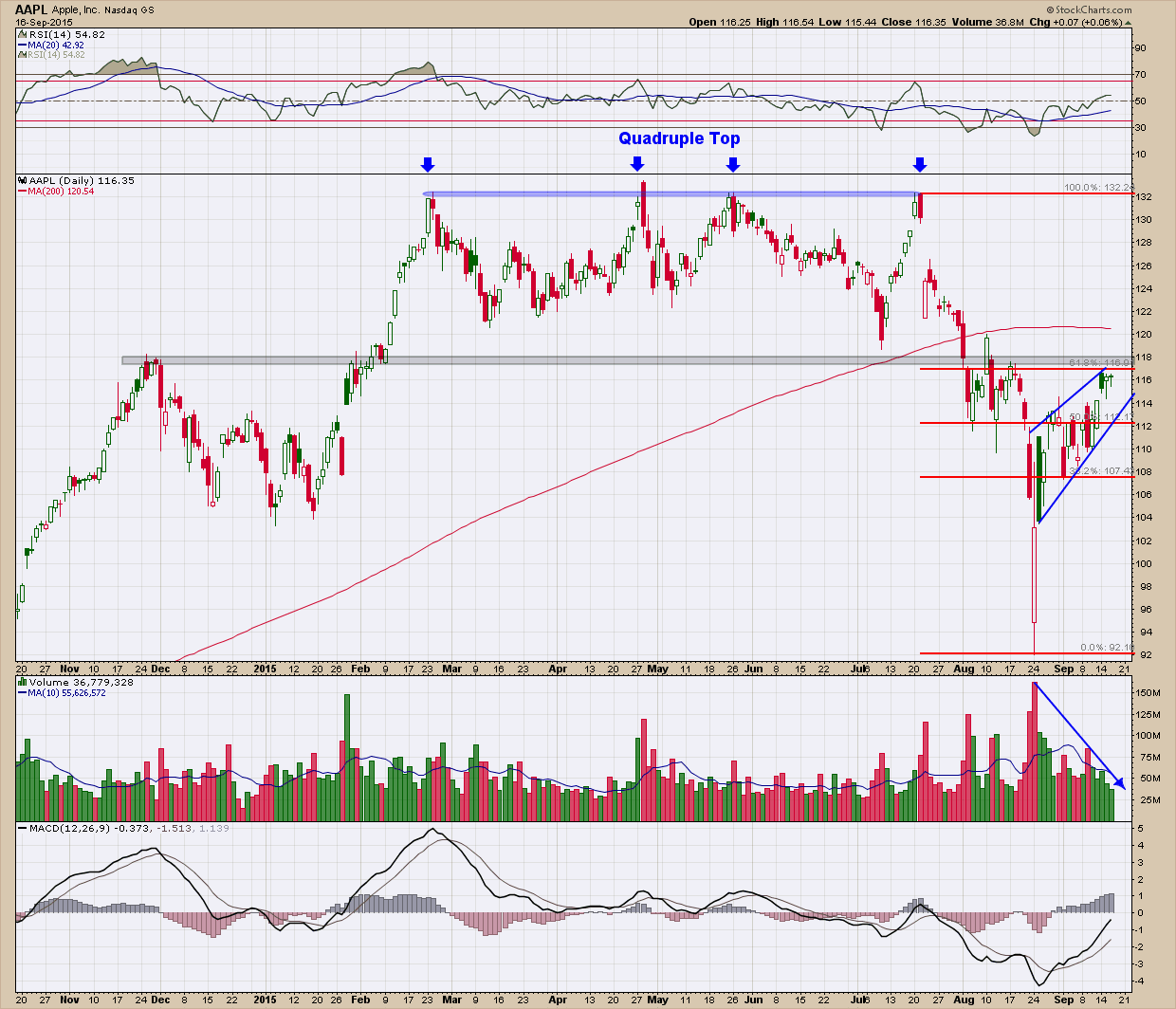

Below is the daily chart of AAPL showing a rare quadruple top (~$132) that formed just before the big sell-off last month where it bottomed at ~$92. You can see we have rallied up to the 61.8% Fib retracement (in red) which coincides almost exactly with the $118 (black) line of resistance. For those unfamiliar with Fibonacci retracements, the 50-61.8% levels are where retracements can peter out and die. The horizontal resistance line represents a ton of potential overhead supply where trapped buyers are looking to get out “even” if given the chance. Additionally a rising wedge (in blue) has formed which are typically bearish setups. RSI momentum in the upper pane while above 50 and pointing higher is constructive, it has changed from ranging in the bullish zone and moved lower and is now within the bearish zone. The MACD in the bottom pane, like RSI is constructive in that it is moving higher, it still sits below zero. As buyers we want to see volume confirm price movement but that has not happened, in fact just the opposite. As you can see, volume has declined significantly on the current retracement higher. Finally and very importantly, not only is price below the 200 day moving average, the 200 dma has now flattened and begun to point down, just the opposite of what you desire to see if you expect price to move higher.

When using technical analysis there is no one indicator or type of analysis that provides you a definitive answer, rather it is the weight of ALL the evidence. Right now with the confluence of either neutral or negative evidence, I don’t find AAPL an interesting buy right here. And by correlation, I am just as disinterested in the broader market until, like Apple, it can convert most of the existing “negatives” into positives. And who knows, maybe the FOMC meeting may be the impetus the market needs to turn this around. …… Or not. Stay tuned, we will likely know real soon!