Come on, admit it. You’ve done it, maybe not as much as I have but you have done it. What I am talking about is saying something and then regretting it later. Well, instead of actually saying it I am going to write about it and have to deal with the consequences later.

Today’s blog post is about the bullish setup on JC Penny’s (JCP). Yah, I am speaking of that Penny’s. The company who can’t close their stores fast enough to stop the flow of red ink. The one who have tried to remake and modernize their stores so many times but without success. The one where your mothers (that includes me) took us as kids to shop for clothes for the new school year and they seem to have not changed their inventory since then. Yah, that Penny’s.

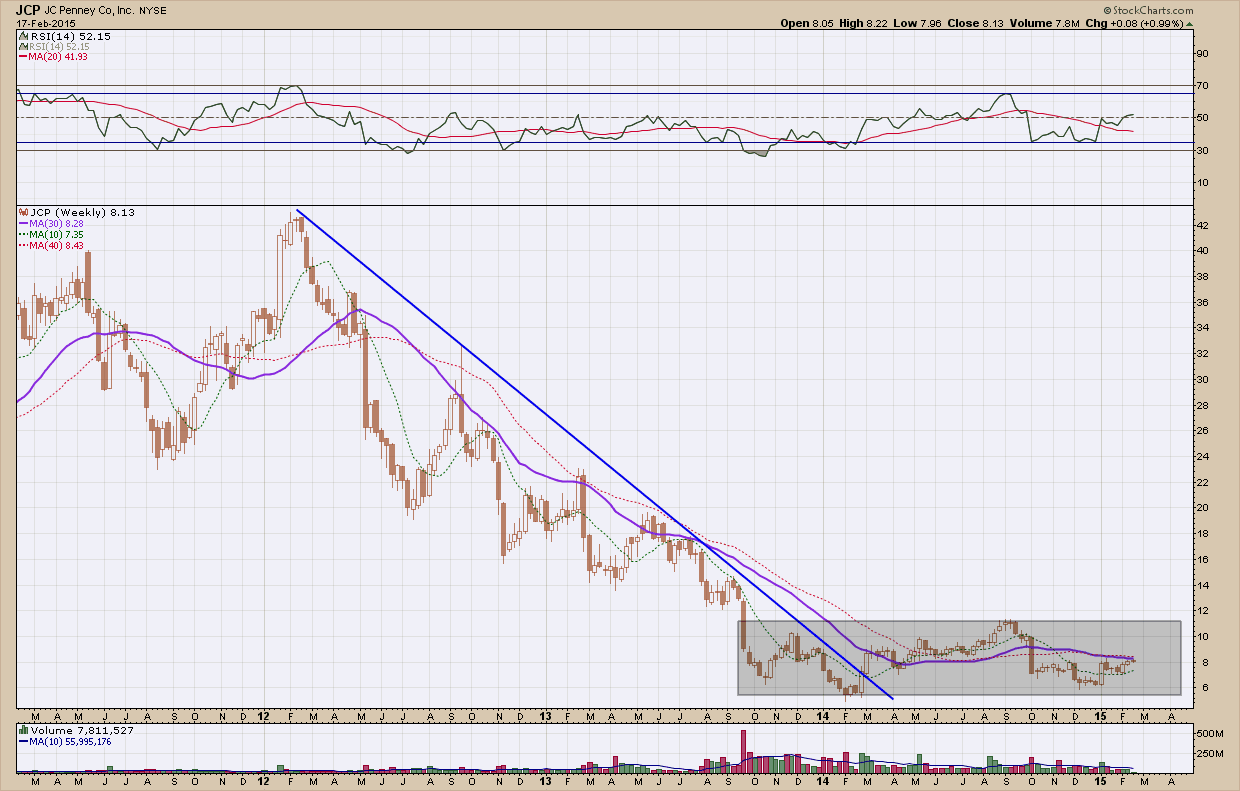

It’s clear from the longer term chart Penny’s has been in a heap of trouble as it has declined almost 80% from its high in early 2012. Since bottoming in January of last year it has been consolidating within the highlighted rectangle, bouncing from top to bottom. From this perspective, I would find it compelling as an investment only if it moved above the shaded rectangle on higher volume (and of course if I forgot which company it was).

The daily chart is definitely more compelling than the weekly vantage point. After peaking in September of last year, it was cut almost in half by the time it bottomed in December, 3 months later. Since then it has clawed its way back and has formed an inverse head and shoulders pattern that, if plays out, projects back up more than $3 higher to the highs back in September. While $3+ doesn’t sound like much, it is a very nice move on a percentage basis, ~40%. Now, that is something that grabs my attention. The only negative here is there is a gap just underneath the right shoulder that will eventually need to be filled. That may be now or much later but it too, grabs my attention and provides a cautionary splash of cold water to this setup.

I am sure if this does not work out (no, nothing is guaranteed), the haters will be sure to never let me forget this post. The good thing about this blog is anything I present is just an idea and informational in nature and not a recommendation. Even the best investment idea can turn out badly if managed incorrectly. Remember, it’s your system that makes you successful, not the investment

As with all my opportunity screens I try to be agnostic as to the company and look only at price. I have found that biases or predetermined beliefs about a company or industry can have a negative impact on returns. So while I have attempted to remember that with this idea all I need to close this post with is ... “yah, that Penny’s”.