In my August 22nd post, “A Falling Knife or Opportunity of the Year”, I wrote about the possibility of “one heck of a reversion to the mean profit opportunity” setting up in coffee. What had my interest was the fact it was massively oversold condition, sitting on very important support and most importantly the smart money was long … very long coffee futures.

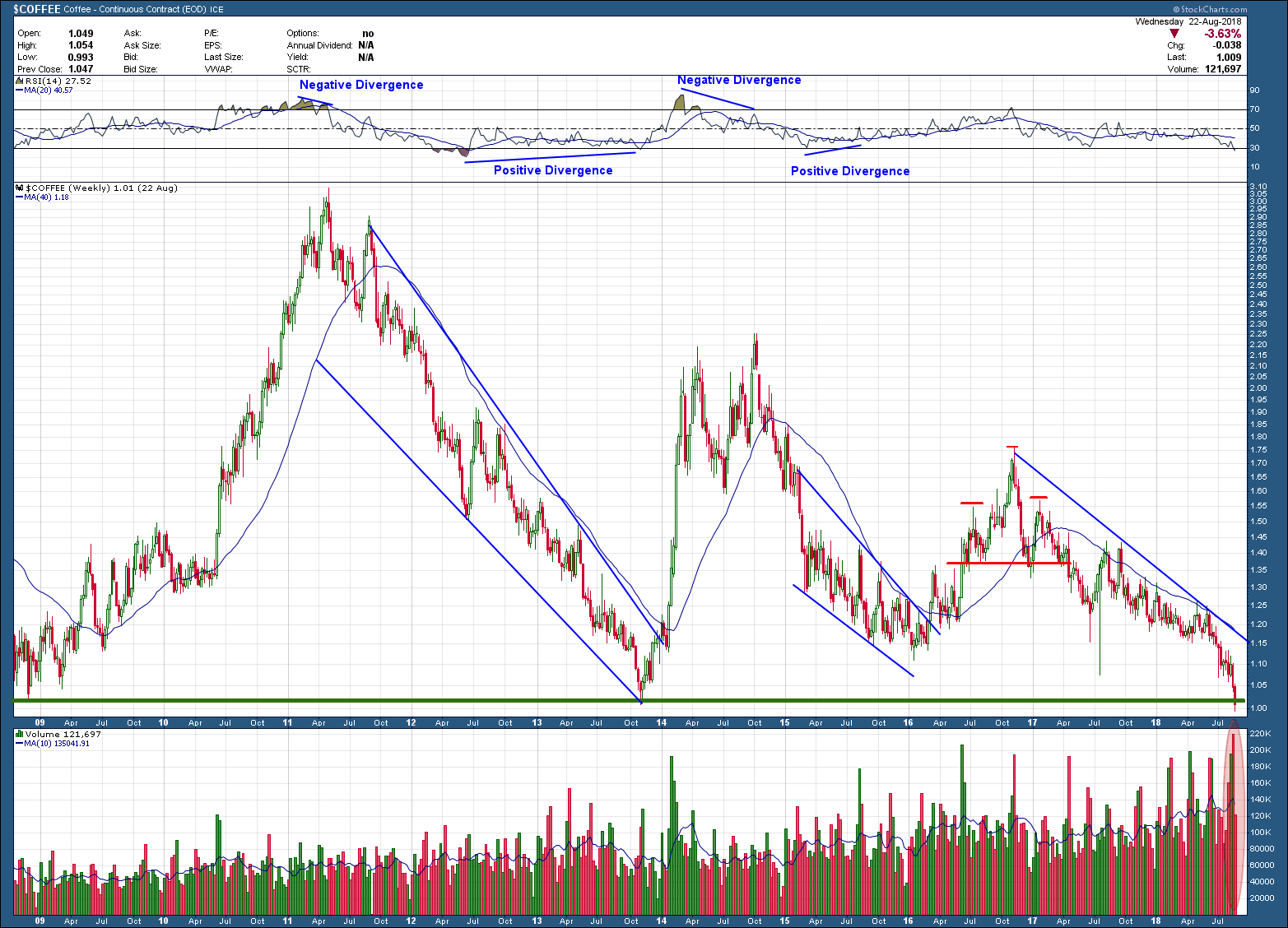

Here was the long-term chart of coffee futures I posted.

My next chart is what has transpired since the post

Right after the original post, coffee went on to make one lower low in price (which took a month to unfold), at the same time RSI momentum formed positive divergence before coffee’s price reversed course to the upside. What occurred next was a 30%+ rise … in just 22 trading sessions. At this point though it is overbought, run into major overhead resistance (supply), has formed negative RSI divergence and closed last week with 2 indecision doji candles, one being a gravestone. This is enough of a warning for me that the current run is tired and likely done. This type of movement is every traders/investor’s dream and when they occur are usually caused by a short squeeze. For those that are short, when the price of the investment begins to move higher, the higher the price goes, the more investors buy back shares to close out their short positions. This covering is the fuel needed to push the prices higher and higher. Every squeeze eventually run out of gas once most of the short positions have been covered and are usually followed by a big reversal to the downside. So, if you are lucky enough to be on the right side of a squeeze, try and ride it for as long as it wants to go and then get ready to get the heck out of Dodge before the rug gets pulled out from underneath you.