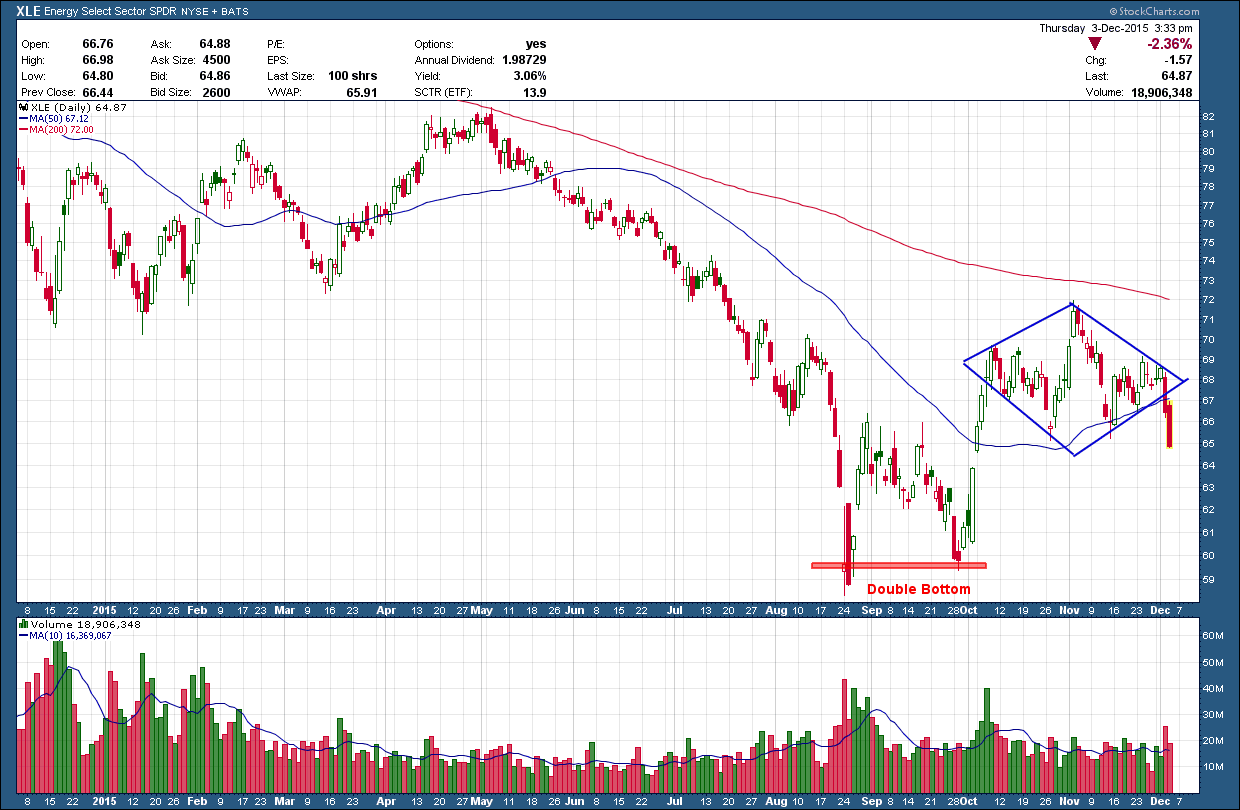

Diamonds are a relatively rare pattern so I wanted to take a look at one that has recently developed on XLE. The diamond pattern is made up from two back-to-back symmetrical triangles and warn of a potential reversal ahead. Like their triangle makeup, they are often subject to reversals after a breakout so their management can be challenging. As you can see in the energy sector ETF, XLE, its price followed the path of lower oil prices, losing 30% from its peak in May of last year creating a double bottom. From there you can see price climbed higher and then began to consolidate which has allowed it the time to develop the diamond.

Price broke decisively lower Wednesday and confirmed the move with larger than normal volume. The follow through on Thursday provided additional needed to tell us this is likely not a whipsaw/fake-out and to expect lower prices ahead. The pattern target is back down at the prior double bottom lows around 59 1/2. I would expect short sellers to jump on board and add more strength to the downside so I would not be surprised by an overshoot of the target.

There should be no surprise to expect lower prices as not only are we below the (red) 200 day moving average but it has a negative slope which is a huge red warning flag any long investor is fighting the trend.

Remember safety first. Don’t fight the Fed. Don’t fight the trend and don’t eat week old sushi!