Earlier in the quarter the Dow Theory warning light started flashing as the transportation index began to fall and created divergence with the industrials which continued to rise. I won’t spend any more time on the Dow Theory as I have beat this concept to death in the past. When a sector begins to breakdown I find it extremely useful to analyze some of the components to see what is “under the hood”. What I wanted to show you in this post is one of the components of the transportation index, American Airlines. I selected it as I couldn’t find a more textbook example of symmetry in price movement and I thought it would be an excellent teaching vehicle. Rarely are topping patterns this pretty and uniform. Presenting a sloppy image that is hard to visualize is a tough sell when trying to teach, trust me so I just couldn’t pass up the opportunity.

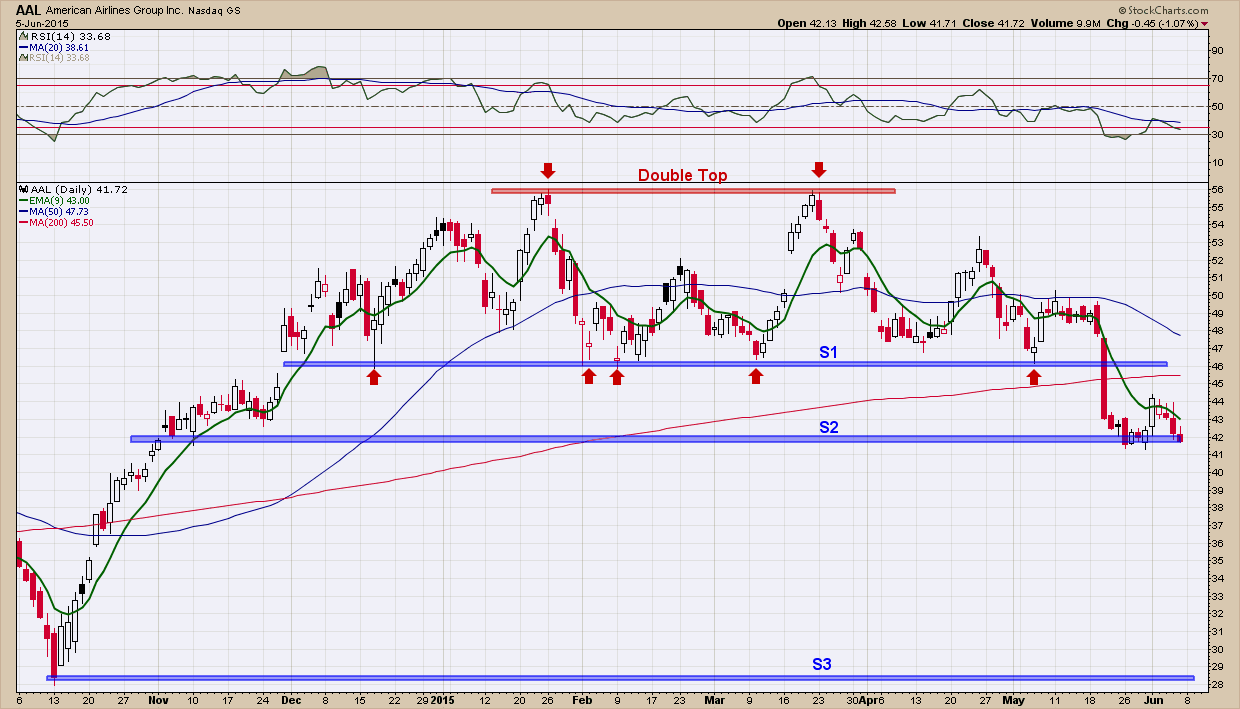

You can see in the daily chart of American Airlines (AAL) below, price created a high in January of this year around $56, which I have marked by the left-most red “down” arrow. After that, price declined and bottomed near $46 (I have drawn a blue horizontal line at that level and labeled it “S1”). After bottoming, price chopped around in a $4 range for a month when the bulls once again took control in March and pushed it back up to the prior $56 high where the bulls ran out of gas creating a double top and major line of resistance. Immediately thereafter price quickly began to move lower, chopped around again and finally bottomed where? Yup right back at $46. You’ve probably already noticed how that $46 level provided support many times as it was touched at least 4 times (highlighted by my red “up” arrows) and each time it was hit, it bounced higher. Well that is until the middle of May where that “support” finally gave way and price blew right through proving the old adage that the more times price hits support the greater the probability it will bust through it.

Hopefully in trying to follow price action with my explanation it is becoming easier to see how being able to recognize and use lines of support and resistance are valuable tools in investment management toolbox. If you fast forward to where we are today you can see we are sitting right on the next level of support, “S2”. If we continue to test that level and eventually break below “S2” like we did “S1” where do you think the next likely support level would be? To find that answer you need to look left and see how price acted on the way up. You can quickly see there is really nothing until “S3” which is ~$28. So, if you still owned this investment (and did not sell on the break below “S1” which confirmed the topping pattern was “in effect”) the question you need to ask is if it breaks below “S2” are you willing to hold it in the drop from “S2” to “S3” (an additional 33% loss) as that is a likely target? Or do you cut your loss and move on to another investment that is in a clear uptrend? Right now anyone owning this is hanging by a thread as the weight of the evidence is in favor of the bears. Hopefully this example helps to illustrate why all investors have an exit strategy in place BEFORE purchasing any investment as eventually every investment is faced with succumbing to bear market losses. Nothing goes up forever.

I can’t end this post without pointing out the beautiful symmetry of the (double) topping pattern that has formed (so far). From the first break above “S1” in December of last year, price formed two “humps” and then topped out at $56. From there it fell back to S1, and then moved almost exactly ½ the way from “S2” to “S1”. That entire move was almost 3 months. Notice how over the next 3 months price did an almost exact backwards retracement of what just happened the prior 3 months before. This is a symmetry at its finest. When symmetry happens it can provide those who recognize it a very powerful edge as it gives a potential road map of future price movement. Armed with symmetry and with a confirmed break below “S2”, the road map it is painting is clear: expect price to follow a reverse course from “S2” to “S3 as it did on its rise from “S3” to “S2” in October of last year and find a bottom.