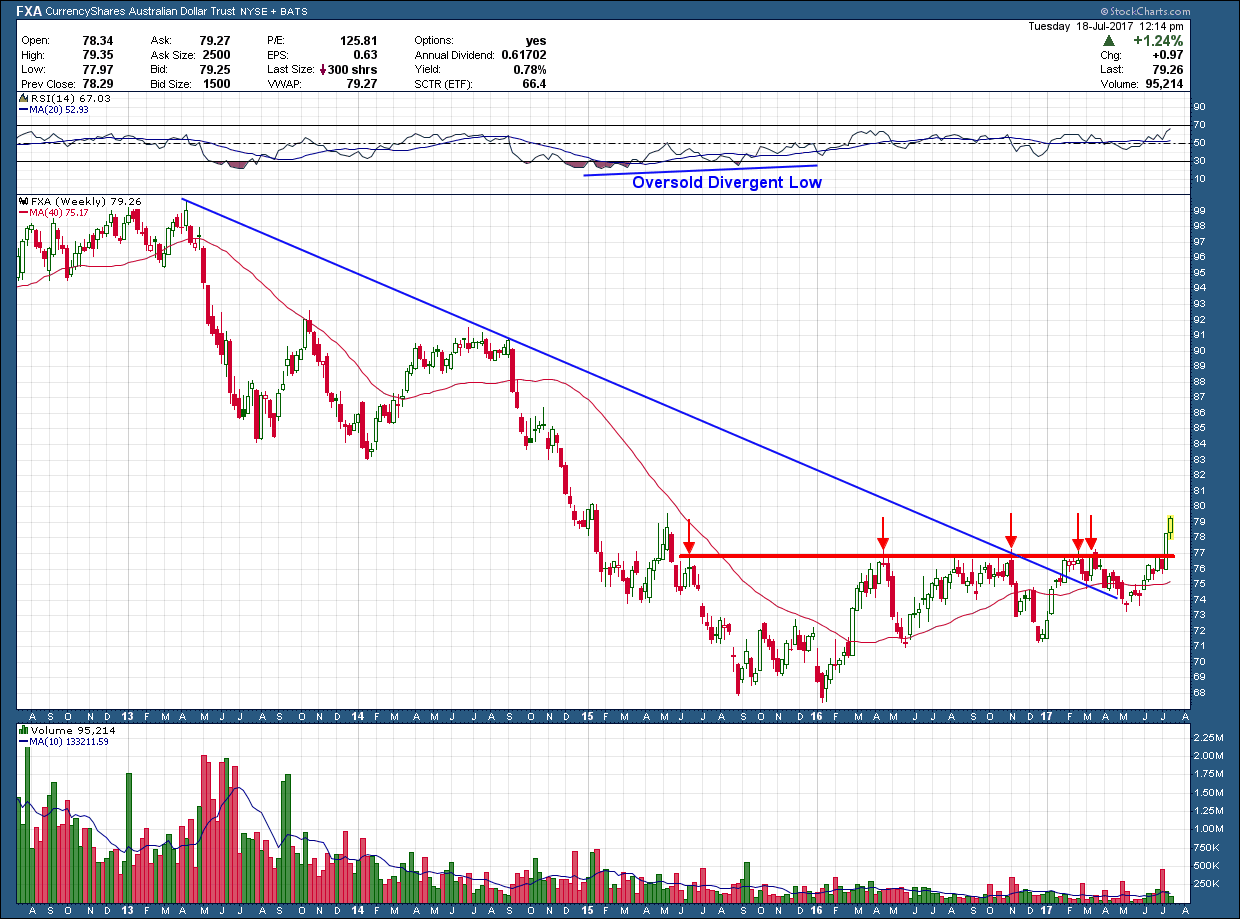

To my surprise, the US Dollar (USD) failed to hold its longer term uptrend and broke down through a 2 ½ year consolidation last month. Its swift decline set up a rally in other currencies, including the Aussie Dollar (AUD) as you can see in the chart below.

Since the breakout, the AUD has rallied to just under prior resistance. If the USD continues to remain weak and the AUD can break out above current resistance, the upside target (which I have labeled as T1 on the chart) is near the 2014 highs, a compelling 12-15% upside from where it closed yesterday.

Australian sovereign bonds tend to pay a healthy premium to their US counterparts so those looking for yield could investigate them for a fit into their portfolio. Along with the higher yield, investors, by way of exchange rate risk, would be able to receive not only the out-sized yield but the potential of the capital gain if the upside target on the above chart were met. Of course, that same exchange rate risk can be a headwind if the USD were to reverse its lower trajectory and push other currencies, including the AID lower so it is critical you have a well scripted management plan if you elect to venture ahead.

The final months of 2017 should be very interesting for those playing in the currency markets as the USD (and by default its relationship to all other currencies) will be dictated by not only our Federal Reserve policy changes and whatever the current administration can enact. While no one assumes the current administration will be able to accomplish anything, I am very wary of accepting this position as I have learned that when the majority are on one side of an opinion, it is best to be on the other, especially when it comes to investing since the majority are almost always wrong.