Checking in with the Mexican stock market I find a nice opportunity developing. But probably not in the traditional way you have been trained to think. For trend investors it’s possible to make money in investments that are moving up or down but not sideways. So, in this post I wanted to take a look at a short trade setup looking to make money as the price of a stock falls. I don’t spend a lot of time addressing these types of opportunities here in the blog because I am not able to short stocks for my clients but that does not mean others reading these posts shouldn’t learn and have the potential to capitalize. What I am trying to teach is a process, not a specific trade or investment. Remember ...

“You need to establish a process and stick to that process. You need to know what you’re going to do any given day and for any given investment scenario. Because if you don’t have a plan, when you get punched in the face by the market you’re not going to react well. Process is everything.”

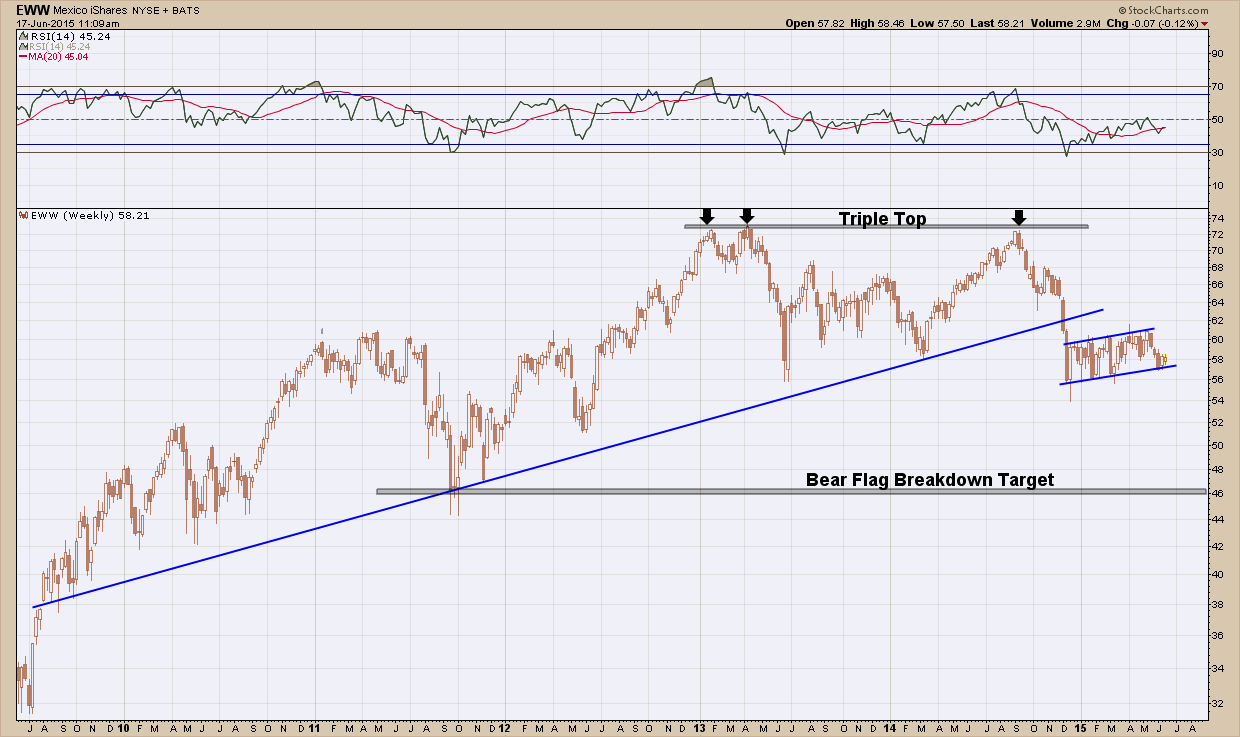

The Mexico stock market ETF, EWW has been in rising uptrend since its bottom in 2009 and has stayed above its (blue) support line until the end of last year. After attempting to break higher three times and failing (creating the triple top), EWW fell almost 18% in the period of 3 weeks and found support at $56. Since then it has consolidated, chopping sideways (within the rising blue channel lines) frustrating the bulls and bears alike. It’s quite common to see consolidation patterns form just under a major breakouts (up or down) and this one is no different. This pattern, on a break below the bottom blue channel, has a projected target at the prior 2011 lows, $46. This works out to just over a 20% fall.

I love 20% opportunities. There are, of course, no guarantees, but a nimble trader shorting the ETF on a break of below the channel with a stop back inside the channel would get a very attractive ~10:1 risk reward ratio and a chance for a 20% return. I like those odds.