There are many recognizable patterns that prices develop in technical analysis but few are as important as island reversals (also known as an “abandoned baby” in Japanese candlestick lingo). An island reversal is a reversal pattern that forms with two gaps and price action in between the two gaps. These gaps tell us that the island reversal marks a sudden, and sharp, shift in direction. Even though they are relatively uncommon, island reversals are potent patterns that warrant our attention. The islands can be formed either at the top or bottom of a stock’s price movement, both indicate the prior trend is done and price has reversed.

The alignment of the gaps holds the key. First, note that a bullish island reversal forms with a gap down and then a gap up. A bearish island reversal forms with a gap up and then a gap down. These gaps overlap to create an island of price action, hence the term “island reversal”. The island is above the gaps on a bearish reversal, and above the gaps on the bearish reversal.

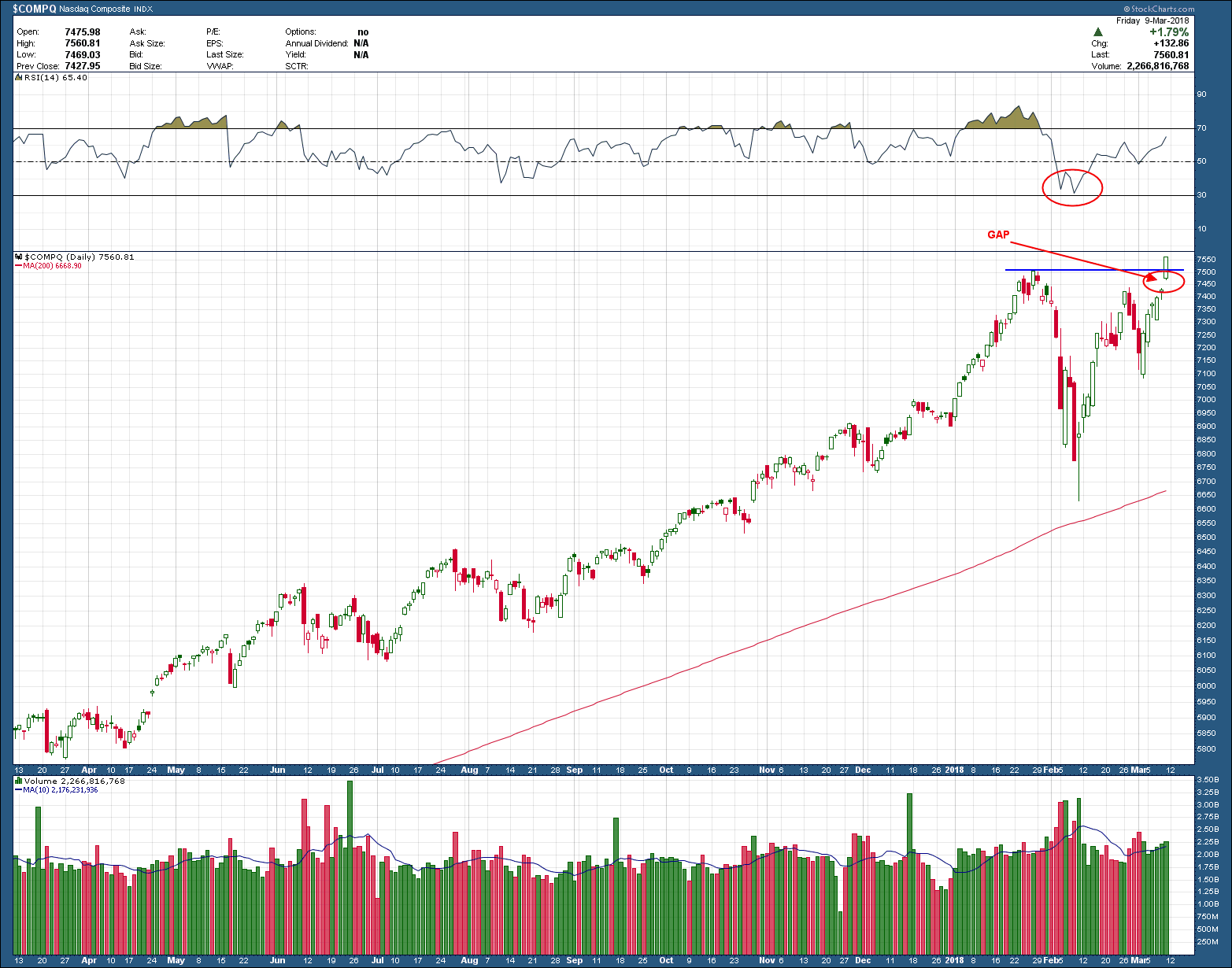

As you can see in the chart below of the Nasdaq 100 index, QQQ, it created a bearish island reversal on Monday when price gapped down below the gap created in the early March move higher. Why islands are important is because traders establishing long positions on the island (and maybe those who initiated on the rise into that island) are now trapped with losses. As such, if price were to move higher from here, closer towards the open gap, you would expect a large supply (sellers willing to sell) to quickly slow, stop, or reverse the advance as those late buyers exit their losing positions. You have often times heard me reference this as “resistance”.