In spite of strong US auto sales this year (annualized yearly sales > 17M), the President’s imposed automobile tariffs has had a direct impact to their stock prices. So far, only Tesla is positive for the year.

What’s Cool

It’s interesting to note this year Warren Buffett turns 88 and his fortune (as calculated by Forbes) totals just under $1B for every year he has been on this planet, at $87B. If you dig a bit deeper into Warren “the human” and ignore his mad business skills and wealth, you find he is actually quite a good human being. He puts money into perspective as you can tell by the top 10 things he thinks are important and, in his words, “cool”.

1. Saying 'thank you'

2. Apologizing when wrong

3. Showing up on time

4. Being nice to strangers

5. Listening without interrupting

6. Admitting you were wrong

7. Following your dreams

8. Being a mentor

9. Learning and using people's names

10. Holding doors open

Even though I need a lot of work on #5 and #10, I couldn’t agree more Warren, that list is pretty cool.

Biases

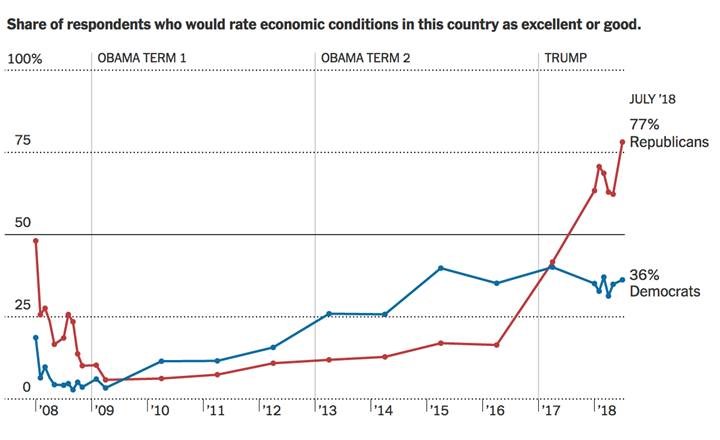

Source: New York Times

Surprise! Partisan politics confuses some peoples’ ability to make objective assessments of economic data:

“Americans’ perceptions of the economy’s prospects increasingly depend more on their political identity than statistics on output or stock markets. “

Is it a cognitive issue? Of course! Salesmanship? Maybe. Bias? Definitely. But why else would the change in POTUS affect anyone’s impression of the economy improving? Is it more likely forward expectations or tribalism?

Truth be told, it really does not matter.

What does matter is this simple bottom line: your biases affect how you see the world, which in turn affects how you think about, well, everything: politics, money, the economy, and of course, your investments.

You can do your best to not allow these elements into your investing strategies, but if you are human, it is all but inevitable that cognitive errors and biases eventually show up in your portfolios . . .

Times They Are A’ Changin’

A decade ago, not one Chinese company made it in the list of the worldwide top 20 tech giants (based upon company valuations). Now, they hold 3 of the top 10 and 9 of the top 20.

Is this a temporary passing like what happened with Japanese companies in the ‘80s? Or is just the beginning of a longer term shift of power eastward?

June 2018 Charts on the Move Video

Yawwwwwwwn. Sideways chop within the Jan -Feb consolidation range until we see a catalyst. I thought maybe trade war fears would be enough to break the trend but apparently not. Bulls are still in charge. I don't expect to see a resolution for months so until then, sit back, enjoy the summer and check out this month's Charts on the Move video at the link below ...