When it comes to investing, the terms long and short refer to whether an investment was initiated by buying first or selling first. A long trade is initiated by buying with the expectation to sell at a higher price in the future and realize a profit. A short trade is initiated by selling, before buying, with the intent to buy the stock back at a lower price and realize a profit. Most everyone understands what being long is but based upon feedback I am getting from some blogs posts, many are not familiar with what a short sale is. So, today’s post I wanted to share a real time example of a short sale I recently placed in my personal account.

The Mechanics

In order to do a short sale, an investor has to borrow the stock or security through their broker from someone who owns it. Once borrowed, the investor sells the stock, retaining the cash proceeds. The short seller hopes that the price will fall over time, providing an opportunity to buy back the stock at a lower price than the original sale price. Any money left over after buying back the stock is profit to the short seller. It’s important to know not all investments are available to short, typically the fewer the number of shares traded on a daily basis the less chance your broker will have a pool available to borrow from.

The Benefits

Shorting, or selling short, allows savvy investors a way to profit regardless of whether the market is moving up or down. The big upside to short selling is that when investments fall they usually fall much faster than they rise so profits can rack up very quickly.

The Risks

Short selling can be profitable when you make the right call, but it carries greater risks than what ordinary stock investors experience. When you buy a stock, the most you can lose is what you pay for it. If the stock goes to zero, you’ll suffer a complete loss, but you’ll never lose more than that. By contrast, if the stock soars higher, there’s no limit to the profits you can enjoy. With a short sale, however, that dynamic is reversed. There’s a ceiling on your potential profit, but there’s no theoretical limit to the losses you can suffer (assuming you hold and never cover – clearly not a good plan).

The Example

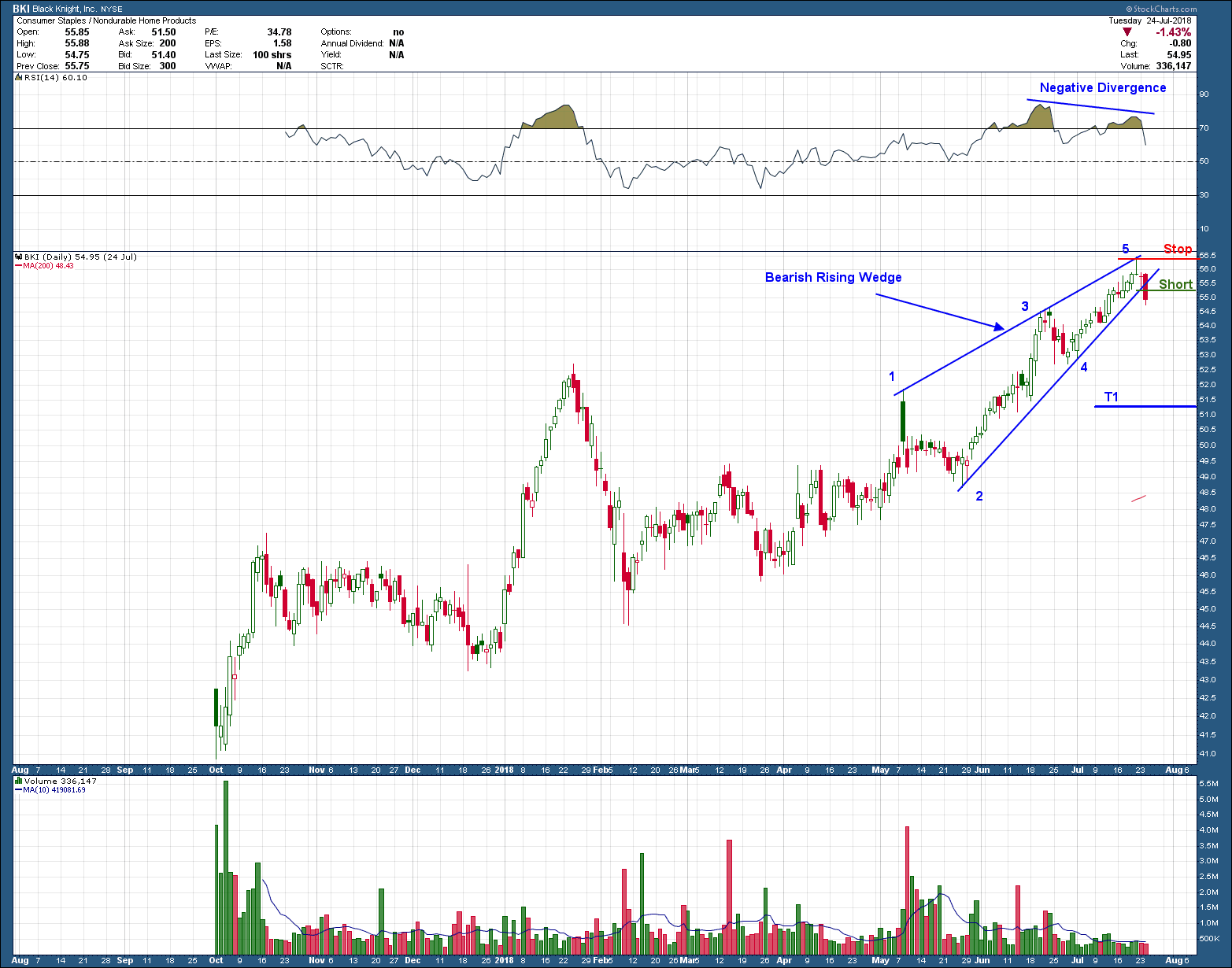

The set up for my short entry in BKI was because it formed a requisite 5-touch bearish rising wedge while RSI momentum begun diverging with price, the warning signs of an impending decline. For wedges, a break and hold below the lower support would be an ideal entry for a short sale, which is where placed my order to borrow shares. The rising wedge’s price objective is down at T1 so if this pattern were to get there it would be my plan to cover (buy) some or all of the shares.

Risk Management (if I am wrong) – If price fails to move lower and climbs higher instead, which it has no business doing if the pattern is real, the top of the wedge (point 5) is a great place to put a stop and exit the position. This equates to a ~$1.3/share loss. If instead, price declines as planned and eventually hits the pattern target, the gain is ~$3.9/ share which provides a very compelling 3x reward to risk for this particular opportunity.

Please note, I have laid out my plan BEFORE I enter that includes the strategy to follow for both a positive or negative outcome. I plan for it to work in my favor but if I am wrong, I don’t want to stay wrong and desire to exit with as small of a loss as possible.