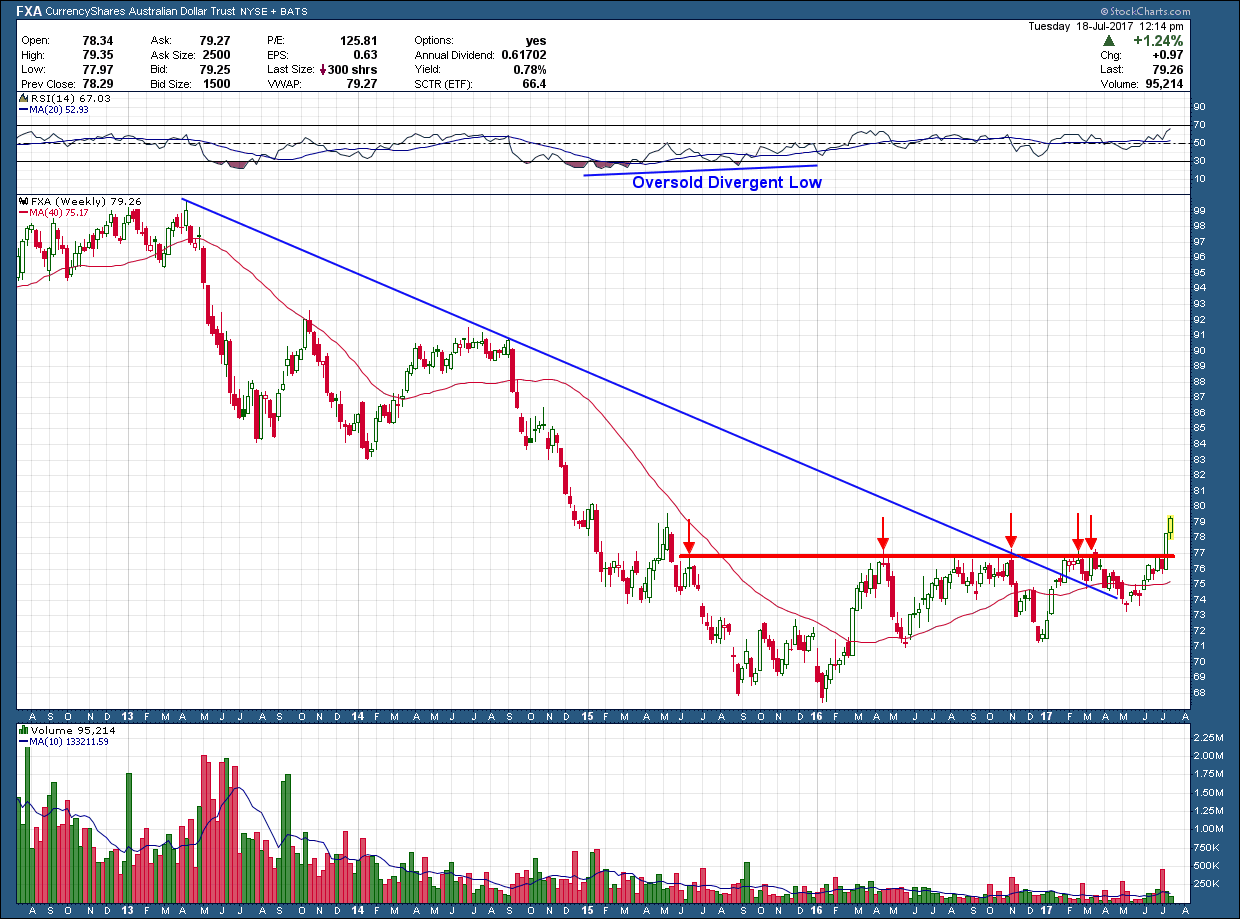

The Australian dollar, like other currencies has had a tough of it over the past few years. After peaking in April 2013 it declined more than 30% in value, bottoming in January of last year. That bottom, like most major declines, formed a divergent momentum low marking a high probability interim low was established. Since that point it attempted (and failed) 4 times to get over the $77 threshold.

Not until last week did it have enough oomph to break that level as it did so with a huge move. In addition, price broke above the blue, long-term downtrend line and sits above a rising 200 day moving average. These are all things we want to see when trying to pick a bottom. The upside target for this breakout is up at the $86-$87 level. Since that is mid- congestion, it could get extended, if it wants to run all the way up to $92. From a management standpoint breakouts are as simple as they come. Sell on a break below support which provides greater than a 4-1 reward for every dollar you risk.