One of my dear clients who had a personality that had its own zip code (and sadly is no longer with us) used to call me up regularly and remind me there was a ton of money to be made in “sinner” stocks and to make sure he owned a lot. To him, “sinner” stocks were those companies providing “booze”, “gambling” and “cigarettes”. He also mentioned “prostitution” but I never had any luck finding a public company to fit that bill for him.

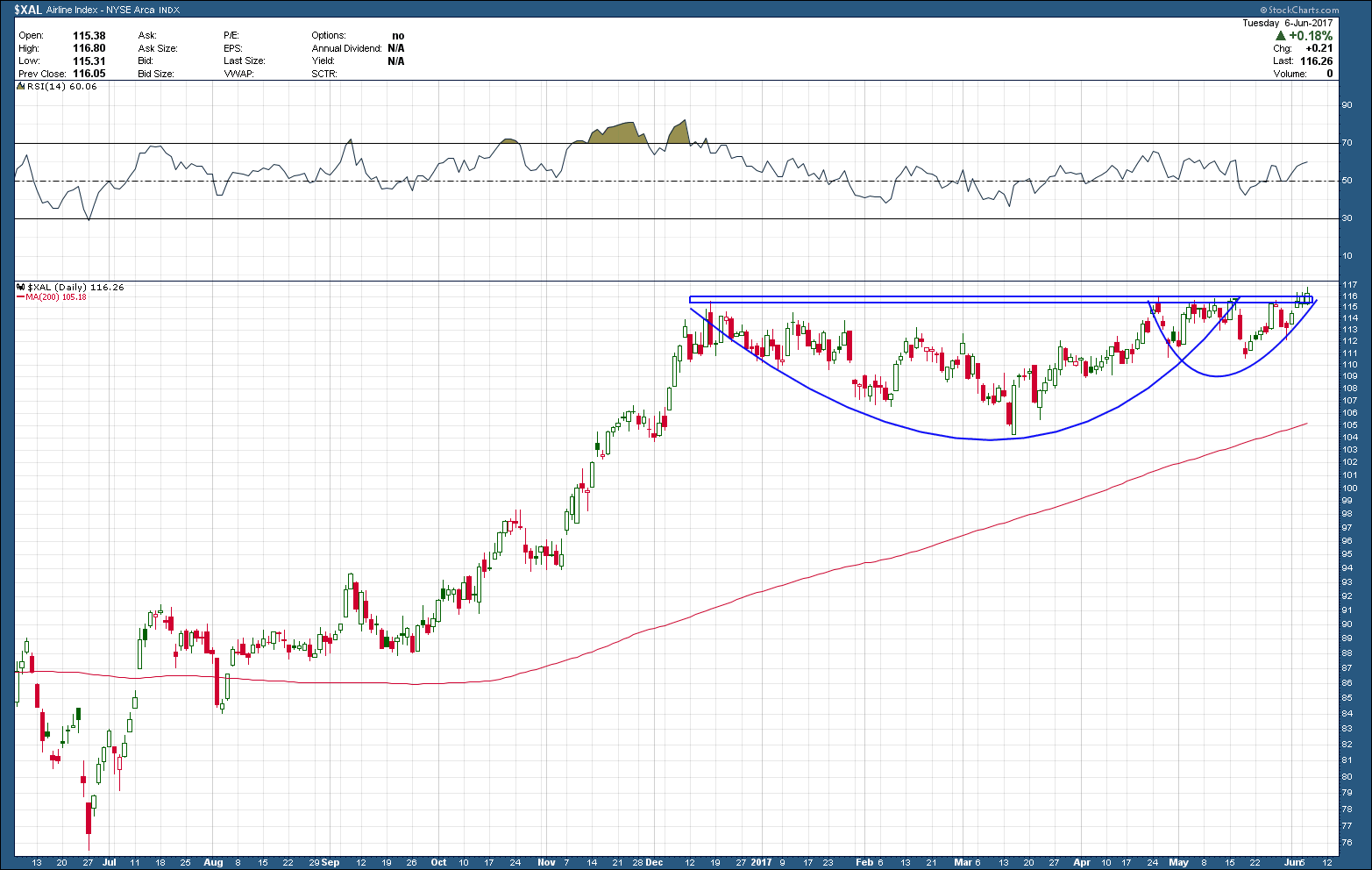

Today’s post is about a Melco Resorts and Entertainment, MLCO one of Asia’s biggest gambling/entertainment companies serving Hong Kong, Macao and the Philippines. As you can see in the chart below, after forming a double top with divergent momentum back in early 2014, its stock was relegated to the unloved investment bin by traders as it fell more than 70% (peak to trough) over the next two years. But since that time it has had a chance to form a very nice, wide base indicating a relief in selling pressure. Price is now above a rising 200 day moving average and sits just under a major resistance zone, while momentum is in the bullish zone. IF this breaks out to the upside, it looks as if it could have a long way to run, assuming the broader market cooperates. I have some reservation as It is very extended from its 200 day moving average and as such I would love to see it pullback/consolidate soon. The fact price sits just under a major resistance zone makes this a logical place for it to rest. Either way, I find this a compelling opportunity and would be looking to enter it on a “confirmed” move above major resistance.

If you are particular in the types of investments you own, “sinner” stocks like MLCO may not pass the screen. If not, this one’s for you Bruce (R.I.P).