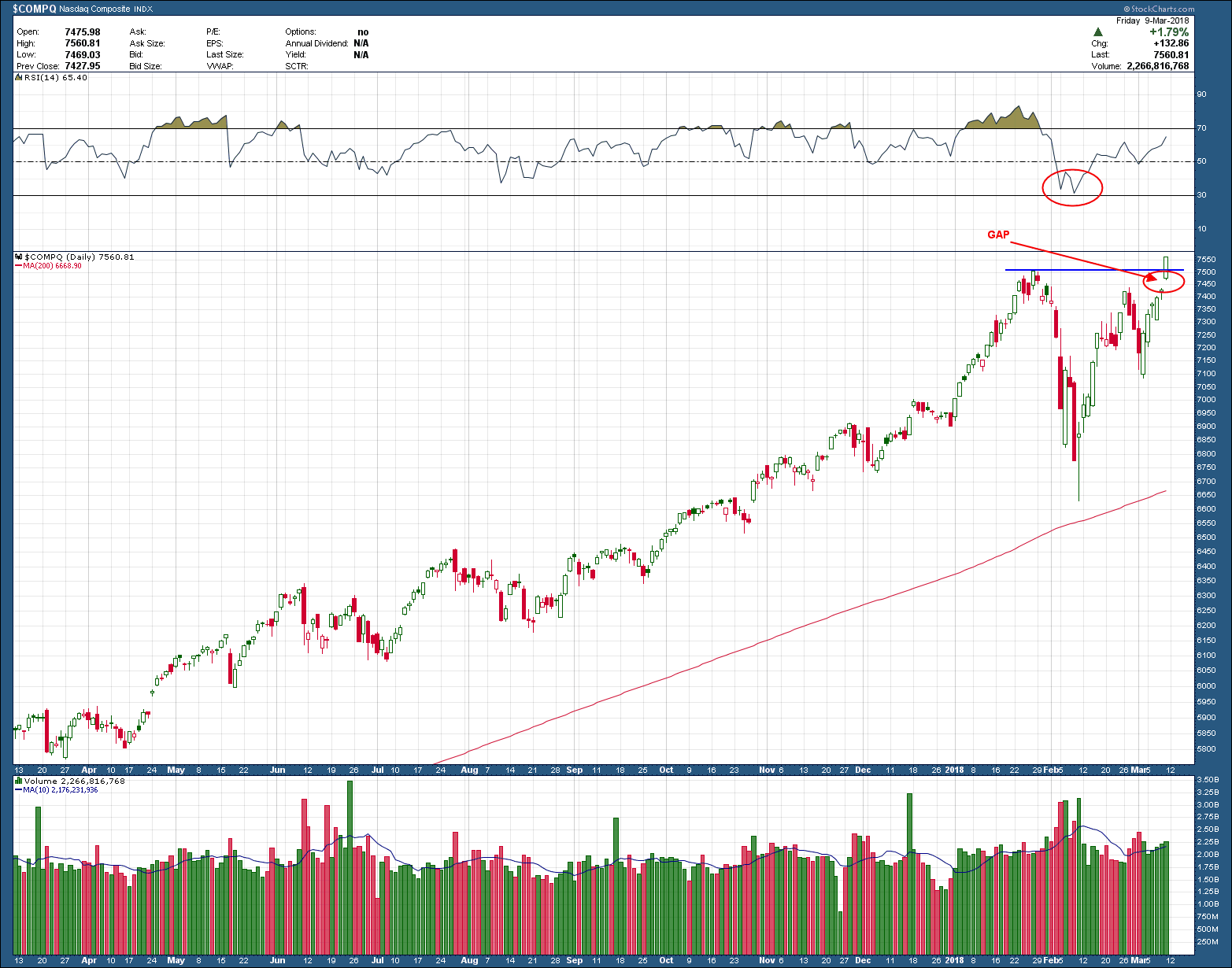

When looking at the US stock market in its entirety, the Nasdaq composite is arguably the most important index. While it is not the broadest measure of the entire market, it does hold the most significant of current technology companies paving our future. As such, the Nazzy typically leads the market, both up and down and a reason I follow it so closely.

With February’s market correction, top callers and psychic hotline workers around the globe begun to ring the bell calling for the end of the stock bull. Of course, anything is possible but the Nasdaq composite is telling us a much different story. As you can see, Friday’s open gapped higher and eventually closed the day at an all-time high. RSI momentum, held above oversold levels during the recent pullback but still has a lot of room to run to the upside before being overbought. Friday’s close also completed a cup and handle pattern which, if the break holds and the pattern completes, points to a target up around the 8245 area.

There is no question bull market will end and someday those same top callers will be ringing their bell once again, eventually getting it right (even blind squirrels find a nut occasionally). I can say with high confidence bull market tops don’t occur when the most important index is braking out to all-time highs.