Many companies now offer employer-sponsored Roth 401(k) retirement accounts alongside traditional 401(k) plans, giving employees another way to save for retirement. What's the difference? And should you open one?

The answer will depend on a variety of factors. Here we’ll take a look at how Roth 401(k) plans stack up against their traditional counterparts.

Roth vs. traditional 401(k): the differences

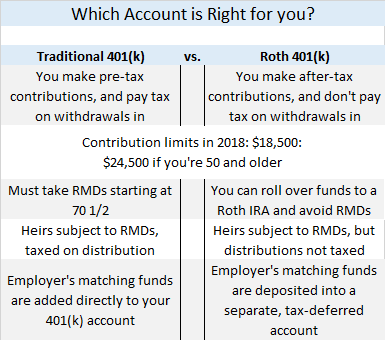

Most people are familiar with how traditional 401(k) retirement plans work: Employees contribute pre-tax dollars into employer-sponsored plans, the money is invested and any earnings grow tax-deferred until they are withdrawn, usually in retirement.

With a Roth 401(k), the main difference is when the taxman takes his cut. You make Roth 401(k) contributions with money that has already been taxed (just as you would with a Roth individual retirement account, or IRA). Your earnings then grow tax-free, and you pay no taxes when you start taking withdrawals in retirement.

Another difference is that if you withdraw money from a traditional 401(k) plan before you turn 59½, you pay both taxes and a 10% penalty. With a Roth 401(k), you can withdraw your principal tax-free before you turn age 59½, as long you’ve held the account for more than five years. (Any earnings withdrawn earlier, however, will be taxed and subject to a 10% penalty.)

Roth vs. traditional 401(k): the similarities

In terms of the similarities between Roth 401(k)s and their traditional counterparts, the first thing to point out are the high contribution limits—which are far higher than those for IRAs, meaning you can save a lot more with a Roth 401(k) than you can with a Roth IRA.

In 2018, you can contribute up to $18,500 a year to a 401(k) (or $24,500 if you're over 50). IRA contributions are capped at $5,500 per year (or $6,500 if you’re over 50).

Also, there are no income limits for Roth 401(k) contributions. In 2018, you can contribute to a Roth IRA only if your modified adjusted gross income is less than $135,000 a year (filing single) or $199,000 for married couples filing jointly

You can also still get matching contributions from your employer. However, such contributions will have to be made in a traditional 401(k) account, since they can only be made on a pre-tax basis. You’ll just need to have one of each kind of account. One thing to note here is that the annual contribution limit would apply across both accounts. For example, you wouldn’t be able to contribute $18,500 to both types of 401(k) in 2018. You would have to divide that amount, say by putting $9,250 in each account.

A final similarity between Roth 401(k)s and traditional ones is that you must start taking required minimum distributions (RMDs) once you reach age 70½, or face a penalty. However, you can avoid this requirement when you retire by rolling your Roth 401(k) into a Roth IRA—which has no RMDs—so your assets can continue to grow tax-free and they can be passed along to your heirs. This flexibility is a significant difference between a Roth account compared to a traditional 401(k) or IRA.

When a Roth 401(k) can make sense

Taxes are a key consideration when it comes to deciding on a Roth 401(k).

If you’re young, in a low tax bracket now and expect to be in a higher tax bracket when you retire, then a Roth 401(k) could be a better deal than a traditional 401(k). Think of it this way: with a Roth 401(k) you can get your tax obligation out of the way when your tax rate is low, and then enjoy the earnings tax free later in life. On the flip side, it may make less sense to contribute to a Roth 401(k) if you think your tax bracket will be lower in retirement than it is now.

A Roth 401(k) can actually work for mid-career workers, as well, especially those concerned about the prospects for higher tax rates in the future. After all, taxes are currently fairly low by historical standards. The top rate for married couples filing jointly is 37% in 2018, but it was 70% as recently as 1981 and an eye-watering 91% back in 1963!

High earners who expect to maintain their income and spending standards into retirement could also consider using Roth 401(k)s to simplify their taxes by paying them up front while they’re still working. Doing so would also limit the tax impacts of having to take RMDs, which are treated as taxable income.

The potential for tax diversification

If you’re not sure whether a Roth 401(k) makes sense for you, one strategy would be to contribute to both a Roth 401(k) and a traditional 401(k) as well. The combination will provide you with both taxable and tax-free withdrawal options, which is particularly useful if you’re on the fence about what your tax rate will be in your future retirement.

As a retired individual or married couple with both Roth and traditional 401(k) accounts, you could determine which account to tap based on your tax exposure. Since you cannot always know what your future tax bracket will be, the flexibility to use multiple accounts to manage taxes is important and helpful.

For example, you could take RMDs from your traditional account and withdraw what you needed beyond that amount from the Roth account, tax free. That would mean you could withdraw a large chunk of money from a Roth 401(k) one year—say, to buy a dream home—without having to worry about taking a big tax hit.

Besides having the added flexibility of being able to manage your marginal income tax bracket, reducing your taxable income in retirement may be advantageous for a number of reasons, including lowering the amount you pay in Medicare premiums, paring down the tax rate on your Social Security benefits, and maximizing the availability of other income-based deductions.