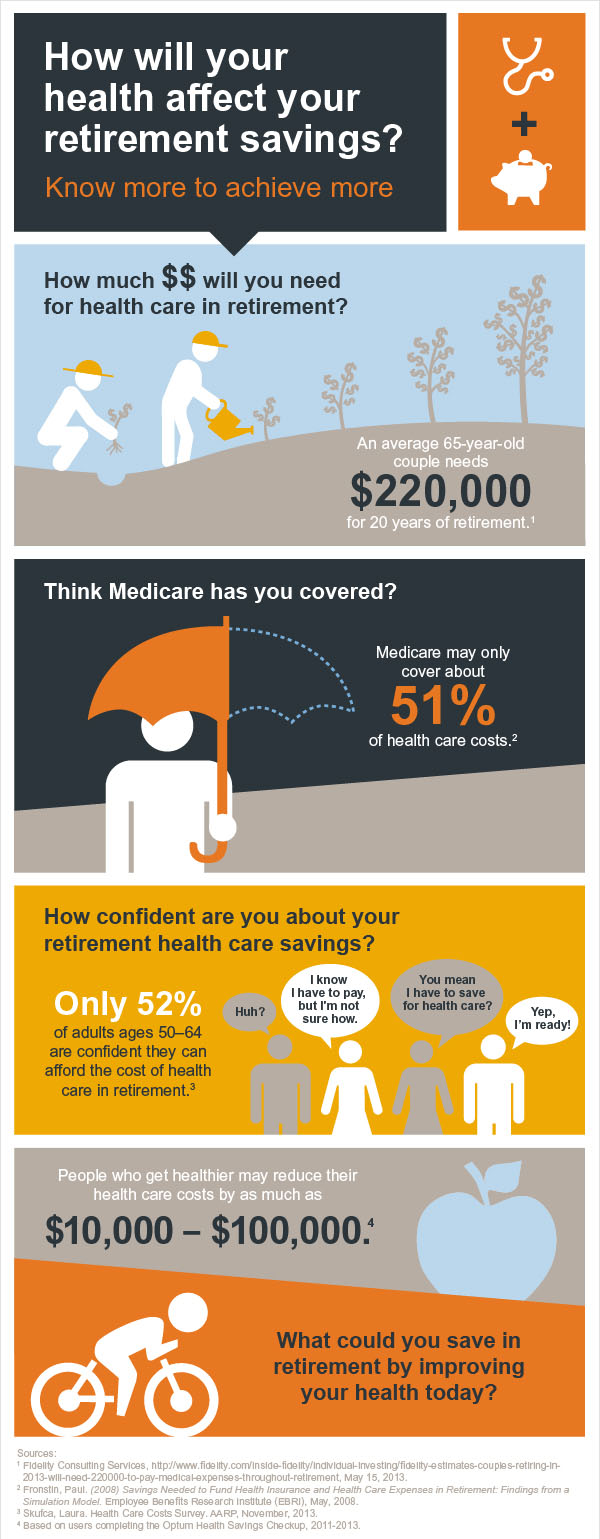

As we continue to push the age of longevity further out, healthcare costs are becoming a bigger and bigger chuck of the retirement expense pie. Many believe that once they reach the age of 65, Medicare will kick in and take care of their healthcare needs. However, studies show that Medicare only covers a little more than half of a retiree’s healthcare expenses. If this shortfall is not something you are actively including in your retirement calculations, it should be.

AARP created the infographic below, which provides some base guidelines when it comes to planning for healthcare costs in retirement. Just consider that new government data recently reported that the average sticker price for medical procedures rose from 2011 to 2013 by 10 percent (far outpacing inflation), and you’ll begin to understand what impact these costs could potentially have on your retirement.