When it comes to retirement, even the best-laid plans can sometimes go awry. Should the market turn against you, for example, or employment opportunities dry up, even the most diligent savers may find they need to stretch their dollars further than anticipated.

So, what are the best available options? Here are four common fallbacks—and the pros and cons of each.

1. Save more

Setting aside a greater amount each month is perhaps the most obvious strategy. But by the time you discover a shortfall it may be too late. After all, compound interest—which accounts for the lion’s share of many retirement portfolios—needs time to work its magic.

A little goes a long way. A person who invests just $3,000 a year for 40 years could end up with nearly $500,000—three-quarters of which would be from compound returns.

The chart above is hypothetical and for illustrative purposes only. Earnings assume a 6% annual rate of return and do not reflect the effects of fees or taxes.

The power of compounding depends on three factors: How much you save, how much you earn on your savings and how long you save. Lengthier time frames benefit the other two—which is why it’s so important to start early.

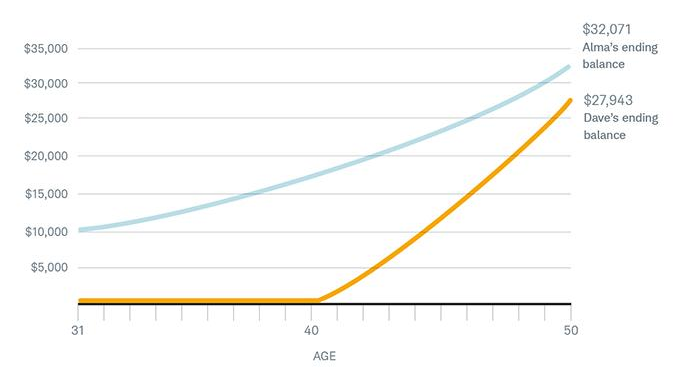

Early beats often. Alma invests $10,000 when she’s 31 and lets the money grow for 20 years. Dave invests $2,000 a year, beginning at age 41, for 10 years. By age 50, Alma has nearly 15% more than Dave, despite having saved half as much.

The chart above is hypothetical and for illustrative purposes only. Earnings assume a 6% annual rate of return and do not reflect the effects of fees or taxes.

2. Risk more

Another tempting response to a loss may be to take more risk with your investments in search of greater potential returns. But the correlation between risk and potential reward typically holds true only over the long term, and even then, it isn’t perfect.

Younger investors, who have the luxury of time to ride out market ups and downs, might feel comfortable holding more-volatile assets. But if you decide to embrace risk in your later years you should do so with only a fraction of your funds. For example, one way to go about this it to set aside the savings required to pay necessary expenses and then use a portion of what remains to pursue a more aggressive strategy.

3. Work longer

Most people assume they will just keep working if their retirement savings fall short. This is a legitimate backup plan, but it’s far from foolproof. For example, health issues or a corporate restructuring can force a person to retire earlier than anticipated.

Statistics support this. In 2017, 48% of retirees left the workforce earlier than they had planned, according to the Employee Benefit Research Institute’s 2017 Retirement Confidence Survey. Health issues were the most common reason, cited by 41% of those surveyed, while 26% said a change at their company was the cause.

Breaking ties. Most of the reasons older workers face early retirement are beyond their control.

Source: 2017 Retirement Confidence Survey, Employee Benefit Research Institute.

In other words, if working longer is your sole backup strategy, you may want a backup plan for your backup plan.

4. Spend less

For most people, cutting expenses is perhaps the least desirable option; however, it’s also the most common when all else fails. Redefining what a comfortable retirement looks like is sometimes necessary, but that doesn’t mean it has to be Draconian.

Together with your spouse—and, if appropriate, an accountant or a financial advisor—review which expenses are discretionary and which aren’t. If you think you’ll need to pare down in the future, practice changing spending habits in the present to see what’s really possible.

Sometimes it takes a big move—literally—to make ends meet. Relocating to an area with a lower cost of living can sometimes be enough to get your spending on track.

Location, location, location. When push comes to shove, cash-strapped retirees may want to move inland, where the cost of living in major metropolitan areas is often less than 100% of the national average.

Source: Cost of Living Index, Council for Community and Economic Research. Data as of Q3 2016. The Cost of Living Index measures relative price levels for consumer goods and services in participating areas. The average for all locales equals 100, and each participant’s index reading is a percentage of that average.

As with your principal retirement plan, it’s best to begin formulating your backup as early as possible. Time is truly your best friend, not just when it comes to investing but also when it comes to taking the necessary steps to secure a comfortable retirement.